Anyone familiar with that strip of Ossington Ave running north from Queen Street up to Dundas knows there's been quite a bit of change there in the last few years. The number of bars, restaurants, shops, and galleries that've sprung up is impressive. I live in the surrounding area myself and can attest to the difference a few short years makes. In terms of real estate values alone, the area has certainly experienced an increase. I helped some clients purchase a townhouse on Halton St, just east of Ossington, and the prices there have certainly benefited from what's happening in the area.

Anyone familiar with that strip of Ossington Ave running north from Queen Street up to Dundas knows there's been quite a bit of change there in the last few years. The number of bars, restaurants, shops, and galleries that've sprung up is impressive. I live in the surrounding area myself and can attest to the difference a few short years makes. In terms of real estate values alone, the area has certainly experienced an increase. I helped some clients purchase a townhouse on Halton St, just east of Ossington, and the prices there have certainly benefited from what's happening in the area.

So much change though, so quickly, isn't going to sit well with everyone. A number of residents in the immediate area voiced their concern about the increased nightlife and the city responded by placing a moratorium on new bars.

Personally, I'm somewhat divided on the moratorium. I'm happy for anything it's done to curb the over-saturation of clubs that some feel was on the horizon. But I'm also disappointed that a less restrictive solution wasn't adopted - a solution that would've allowed for more bakeries, daytime restaurants, etc, to find their way onto the strip.

This isn't to say that there hasn't been any growth along the strip since the moratorium went into effect last year. In fact, galleries and art spaces have really flourished. There was an article in yesterday's Toronto Star touching on this very subject. Take a look:

Following is Sarah Barmak's article from the March 14th Toronto Star in full:

One year after a controversial moratorium on new bars on the street was passed, much on Ossington Ave. has seemed frozen in time, with no new eateries and few new shops.

Other than the growth in gallery space, that is. More than ever, the Ossington art hub is alive and vibrant.

Jamie Angell's Angell Gallery relocated to the foot of Ossington from 890 Queen St. W., moving from 700 square feet to a cavernous 4,000. With its grand central space and satellite wings, it isn't hard to imagine Angell as a bustling bistro. Instead, it's now one of the bright lights of a booming creative nexus.

Further north on the strip, Meta Gallery is busily renovating their new space – formerly the eclectic art, market, concert, and event venue Rolly's Garage – for their grand opening on April 2.

The most impressive newcomer to the neighbourhood, the Artscape Shaw Street Centre, will add a mind-blowing 75,000 square feet of dedicated gallery and working space for artists to the area when it opens in 2012. A repurposing of the beautiful century-old Shaw Street School, which had been shuttered for a decade before Artscape bought it in January, the centre will be the largest project to date for the not-for-profit urban development organization behind the Wychwood Barns art community in the St. Clair and Christie neighbourhood.

Artscape's request for expressions of interest from artists – due Thursday – is helping them envision how the space will be used. The prospect of all that room, however it's used, seems likely to lure more artists and arts businesses to the area.

"Galleries could be a part of it," says Liz Kohn, director of communications for Artscape. "Also, music or performance or theatre. The options are endless, really."

The bar moratorium, put in place by ward councillor and now mayoral candidate Joe Pantalone, had split residents – who complained about late-night noise – and business owners, who said the ban penalized people who wanted to open daytime restaurants and bakeries.

Council since replaced that ban with more permanent rules: new bars, cafes, restaurants, bakeries and takeout places are limited to the ground floor and 175 square metres (1,800 square feet). Fears voiced by locals that the strip would wither under the restrictions, however, don't seem to have materialized – for galleries, in any case.

"It's like a village between Dundas and Queen," says Angell, whose gallery has its official launch April 3. "I personally think it is easier for galleries to grow on Ossington."

Angell more than quadrupled his floor space by moving to Ossington while only doubling his rent. He also moved to the area himself, with an apartment above his gallery.

"Much more space enables me to have three distinct galleries," he says – a dramatic main wing for group shows and up-and-coming artists, an east wing, and a project space where visitors see more inventory. The high-ceilinged white rooms elegantly show off the work of talented locals such as Geoffrey Pugen and Alex McLeod.

It isn't just the space, however. One of the most distinctive additions to the new Angell Gallery is a permanent video room. The mini-theatre, with a flat-screen video monitor, speakers and space comfortable for about four to six people, is unique among smaller galleries, which usually install screens temporarily for specific exhibits.

"It's a serious medium," says Angell. "But how many galleries have the space to dedicate to it?"

Jody Polishchuk, owner of Meta Gallery, says he's happy Ossington didn't become a club district. "People were worried it was going to turn into a kind of Richmond Street," he says. "It's such a gem and it would be a shame for it to go that way."

He says he looked for spaces along Dundas West – theorized by many as the new, new art district – before settling on Rolly's. He's happier to think of Dundas West as part of a giant art nexus that includes Ossington and the Shaw complex, anyway.

The new Meta seems likely to become a strip destination: though it will be a gallery in the main, it plans to retain some of the events that made Rolly's Garage such a creative hotspot – such as its unique Night Market, where local vendors sold hand-made designer goods while shoppers drank and socialized.

It has even hired Phil Terry, the same contractor who has worked on the Drake Hotel, W Burger Bar and Mercatto restaurants. Not that it will get a permanent liquor licence. "As if Ossington really needed another bar," says Polishchuk.

Architect Breck McFarlane owns the building at 9 Ossington, which houses electronic media arts centre InterAccess and Imperial Tattoo. He agrees that galleries seem to have emerged from the moratorium unscathed. And he is happy to remind newcomers that the street is a long way from what it was when he bought the property in 2001.

"It was like a country road," he says. "I think there were tumbleweeds, honestly. It's got to be a 25-fold increase in foot traffic (since then)."

Many small business owners along the strip are far less sanguine about life since the ban, however. They say the moratorium didn't stop kids from drinking – and it hurt daytime retail.

"I'm the newest vintage store and I've been here for a year," says Lindsay Fernlund, who owns Silver Falls, across from Angell. She says without places to have lunch, shoppers simply don't linger on the street.

"Restaurants would get foot traffic going," says Tim Hanna, the owner of Ossington bookstore Frantic City. He says that when Pizzeria Libretto opened nearby, he stayed open late and benefited from more walk-ins.

Two daytime restaurants and a bakery have closed since Pantalone's moratorium was put in place – businesses that haven't been replaced. The councillor says eateries and bars are welcome if they comply with the new rules; what's wanted, is variety, not just a bar strip.

"Art galleries, clothing stores and food stores are particularly needed in this area to add to the diversity, and their absence was actually creating a problem to both the business people and the residents," he told the Star's Bruce DeMara last week.

There is also a danger that the new rules and the drop in daytime traffic will make the art community also sour on the street.

"There is not another strip in the city that has so many restrictions," says Gary Hall, executive director of Gallery TPW, which relocated to 56 Ossington in 2006 after 20 years at 80 Spadina Ave.

He says the gallery will "consider all its options" – including the idea of the Shaw Street Centre – when their lease expires in three years.

Others are already thinking about life after Ossington – west of it, that is. Next month will see the opening of Parts + Labour on Queen West near Sorauren Ave., masterminded by owners from The Social and Oddfellows, two hectic hipster hubs within blocks of the Queen/Ossington axis. The group gutted a huge old building that housed a hardware store for decades and spent months creating a slick restaurant and live music venue. What results is sure to transform a forlorn stretch of street – and finally, perhaps, Parkdale.

While Ossington galleries continue to thrive, only time – mainly the summer and its crowds – will tell what the future of the strip holds.

If you’re thinking of making a move to or from the Ossington Ave area, or downtown in general, feel free to contact me for more info.

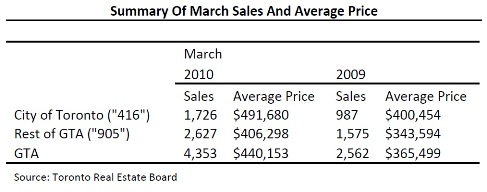

Greater Toronto REALTORS® reported 4,353 sales through the Multiple Listing Service® (MLS®) during the first two weeks of March. This represented a 70 per cent increase compared to the 2,562 sales recorded during the same period in 2009 when resale transactions had dipped markedly due to the recession. The mid-month sales total was also 16 per cent higher than the previous March midmonth high reached in 2006.

Greater Toronto REALTORS® reported 4,353 sales through the Multiple Listing Service® (MLS®) during the first two weeks of March. This represented a 70 per cent increase compared to the 2,562 sales recorded during the same period in 2009 when resale transactions had dipped markedly due to the recession. The mid-month sales total was also 16 per cent higher than the previous March midmonth high reached in 2006.

Anyone familiar with that strip of

Anyone familiar with that strip of  The

The

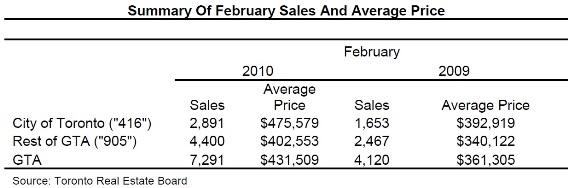

Greater Toronto REALTORS® reported 7,291 sales through the Multiple Listing Service® (MLS®) in February, representing a 77 per cent increase over February 2009. The average price for these transactions was up 19 per cent year-over-year to $431,509. Sales and average price increases represent both increased demand for ownership housing and the base year effect, which involves a comparison of economic recovery this year to a period of economic decline last year.

Greater Toronto REALTORS® reported 7,291 sales through the Multiple Listing Service® (MLS®) in February, representing a 77 per cent increase over February 2009. The average price for these transactions was up 19 per cent year-over-year to $431,509. Sales and average price increases represent both increased demand for ownership housing and the base year effect, which involves a comparison of economic recovery this year to a period of economic decline last year.

Greater Toronto REALTORS reported 3,555 sales through the Multiple Listing Service during the first two weeks of February. This represented a 74 per cent increase compared to the 2,044 sales recorded during thesame period in 2009 when resale transactions had dipped due to the recession. The February mid-month sales total was also 7.7 per cent above the previous high set in 2006.

Greater Toronto REALTORS reported 3,555 sales through the Multiple Listing Service during the first two weeks of February. This represented a 74 per cent increase compared to the 2,044 sales recorded during thesame period in 2009 when resale transactions had dipped due to the recession. The February mid-month sales total was also 7.7 per cent above the previous high set in 2006.

Jim Flaherty and the Government of Canada announced yesterday three changes to the standards involved in Government backed mortgages:

Jim Flaherty and the Government of Canada announced yesterday three changes to the standards involved in Government backed mortgages: Upon its completion in 2003, condo critic Christopher Hume wrote a review of

Upon its completion in 2003, condo critic Christopher Hume wrote a review of

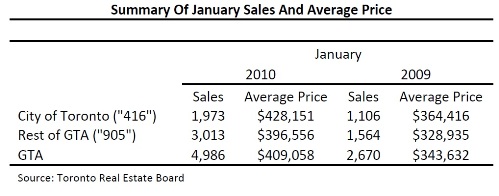

Greater Toronto REALTORS® reported 4,986 transactions through the Multiple Listing Service (MLS®) in January 2010. This result represented a large increase over the 2,670 sales in January 2009 when the home sales were in a recessionary trough. Last month’s sales were slightly higher than the January average in the five years preceding 2009.

Greater Toronto REALTORS® reported 4,986 transactions through the Multiple Listing Service (MLS®) in January 2010. This result represented a large increase over the 2,670 sales in January 2009 when the home sales were in a recessionary trough. Last month’s sales were slightly higher than the January average in the five years preceding 2009.

Last month, in another of my "Condo/Loft Spotlight" posts (

Last month, in another of my "Condo/Loft Spotlight" posts (

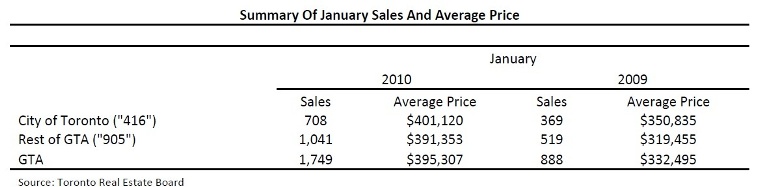

Greater Toronto REALTORS® reported 1,749 existing home sales on the Multiple Listing Service (MLS®) during the first two weeks of January. This result was almost double the 888 sales reported for the same period in 2009, when sales had dipped to a recessionary low.

Greater Toronto REALTORS® reported 1,749 existing home sales on the Multiple Listing Service (MLS®) during the first two weeks of January. This result was almost double the 888 sales reported for the same period in 2009, when sales had dipped to a recessionary low.

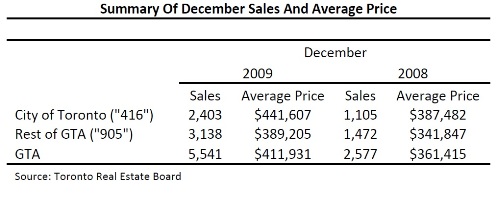

Greater Toronto REALTORS® reported 87,308 MLS transactions in 2009 – a 17 per cent increase over 2008. This result included 5,541 sales in December. The 2009 result was in line with the healthy levels of sales experienced between 2004 and 2006, but lower than the record of 93,193 set in 2007.

Greater Toronto REALTORS® reported 87,308 MLS transactions in 2009 – a 17 per cent increase over 2008. This result included 5,541 sales in December. The 2009 result was in line with the healthy levels of sales experienced between 2004 and 2006, but lower than the record of 93,193 set in 2007.

Needless to say, 2009 was an interesting year for the Toronto Real Estate Market. Back in January we were in the depths of a major downturn that had been in effect since Fall 2008. By late Spring/early Summer however, we were in a seller’s market and prices were on the rise.

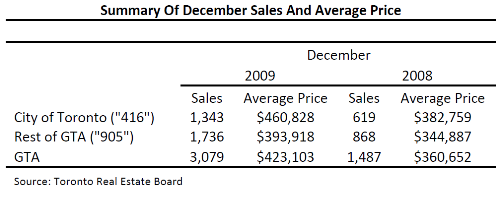

Needless to say, 2009 was an interesting year for the Toronto Real Estate Market. Back in January we were in the depths of a major downturn that had been in effect since Fall 2008. By late Spring/early Summer however, we were in a seller’s market and prices were on the rise. Greater Toronto REALTORS® reported 3,079 existing home transactions in the first two weeks of December compared to 1,487 in 2008. The strong growth represents both increased home ownership demand and the fact that we are comparing the recovery phase of the sales cycle this December with the contraction phase experienced last winter.

Greater Toronto REALTORS® reported 3,079 existing home transactions in the first two weeks of December compared to 1,487 in 2008. The strong growth represents both increased home ownership demand and the fact that we are comparing the recovery phase of the sales cycle this December with the contraction phase experienced last winter.

The real estate market generally tends to slow down during the month of December as buyers put their search on hold in favour of gift shopping, holiday preparations, vacations, etc. Accordingly, sellers usually don’t put their property on the market so close to the holiday season unless they have to. A listing can suffer a bit if it sits over Christmas/New Years with no showings and the thought is that it’s better to wait and list in January/February when more buyers are in the market.

The real estate market generally tends to slow down during the month of December as buyers put their search on hold in favour of gift shopping, holiday preparations, vacations, etc. Accordingly, sellers usually don’t put their property on the market so close to the holiday season unless they have to. A listing can suffer a bit if it sits over Christmas/New Years with no showings and the thought is that it’s better to wait and list in January/February when more buyers are in the market. Greater Toronto REALTORS® reported 7,446 sales in November – slightly more than double the November 2008 result when GTA home sales had dipped markedly due to the economic downturn. Year-to-date sales were up 14 per cent compared to the first 11 months of 2008.

Greater Toronto REALTORS® reported 7,446 sales in November – slightly more than double the November 2008 result when GTA home sales had dipped markedly due to the economic downturn. Year-to-date sales were up 14 per cent compared to the first 11 months of 2008.

My brokerage’s office is located in the

My brokerage’s office is located in the

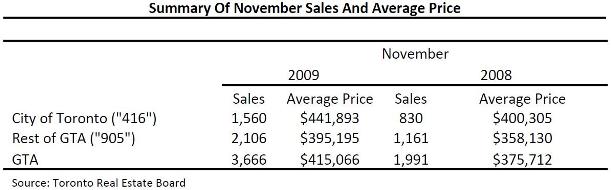

In the first two weeks of November, Greater Toronto REALTORS® reported 3,666 sales – up 84 per cent compared to the first two weeks of November 2008. The average price for these transactions was up 10 per cent year-over-year to $415,066.

In the first two weeks of November, Greater Toronto REALTORS® reported 3,666 sales – up 84 per cent compared to the first two weeks of November 2008. The average price for these transactions was up 10 per cent year-over-year to $415,066.

In

In