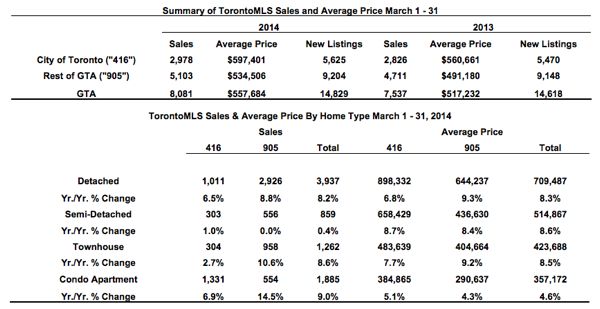

Following is TREB's market report for August 2015:

Toronto Real Estate Board President Mark McLean announced that Greater Toronto Area REALTORS® reported 7,998 residential transactions through the TREB MLS® System in August 2015.

This result represented a 5.7 per cent increase compared to 7,568 sales reported in August 2014.

On a GTA-wide basis, sales were up for all major home types.

The annual growth rate in new listings was greater than the annual growth rate in sales, but active listings at the end of August were still down compared to last year.

This suggests that sellers’ market conditions remained in place, especially where low-rise home types like singles, semis and townhouses were concerned.

“Buyers in the GTA remain confident in their ability to purchase and pay for a home over the long term. They see ownership housing as a quality investment that has historically produced positive returns while at the same time providing owners with a place to live in their chosen community,” said Mr. McLean.

Both the MLS® Home Price Index (HPI) Composite Benchmark and the average selling price for all home types combined were up substantially in August compared to the same period in 2014, with both increasing by approximately 10 per cent year-over-year.

“A record year for home sales continued to unfold in August as competition between buyers exerted upward pressure on selling prices. It was encouraging to see annual growth in new listings outstrip annual growth in sales, but we will need to see this for a number of months before market conditions become more balanced," said Jason Mercer, TREB's Director of Market Analysis.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

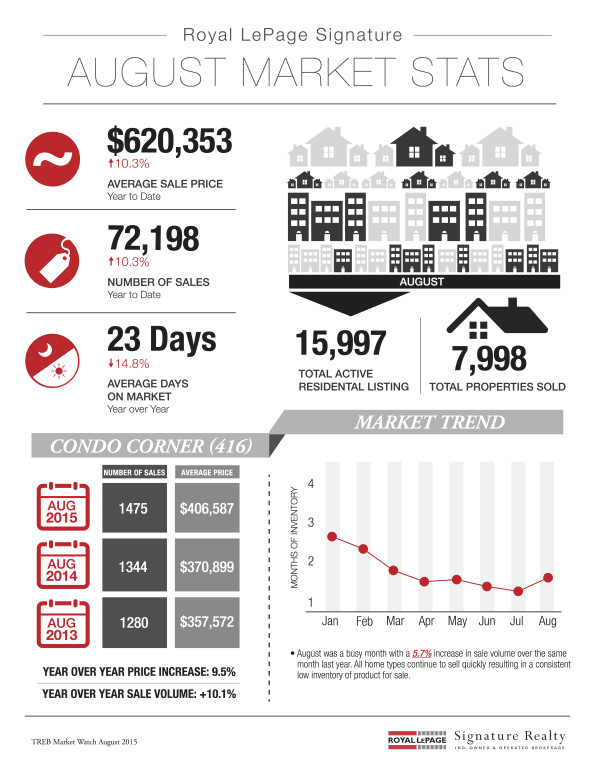

Following is TREB's market report for July 2015:

Following is TREB's market report for July 2015:

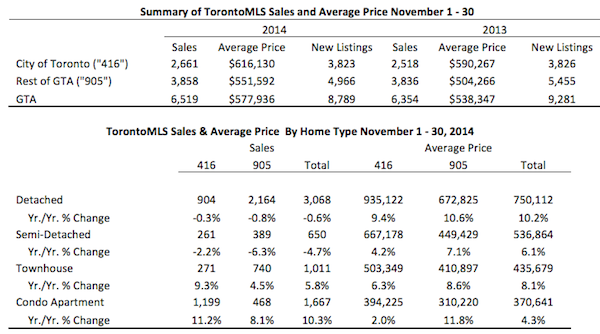

Following is TREB’s market report for November 2014:

Following is TREB’s market report for November 2014:

Back in August I wrote about the sellers who received 7 competing offers on offer-night, and said "no" to all of them (

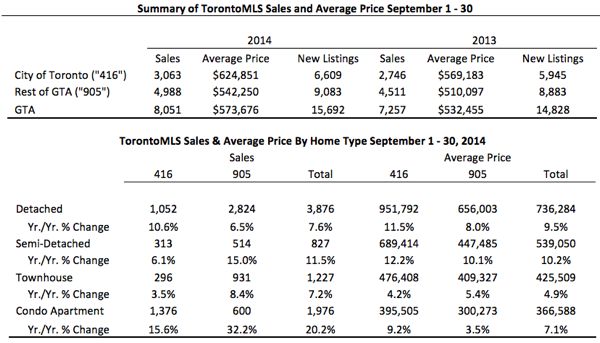

Back in August I wrote about the sellers who received 7 competing offers on offer-night, and said "no" to all of them ( Following is TREB’s market report for September 2014:

Following is TREB’s market report for September 2014:

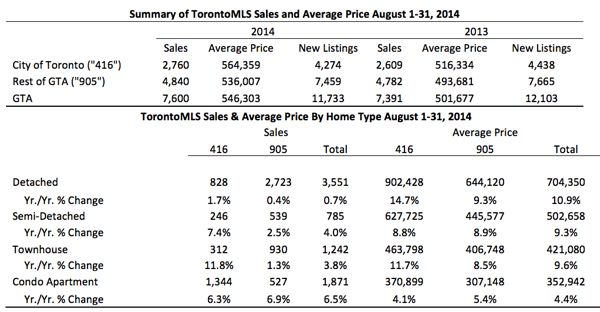

Following is TREB’s market report for August 2014:

Following is TREB’s market report for August 2014:

What happens when a seller receives 7 competing offers on their house, only to reject them all and then relist the next day at a much higher price?

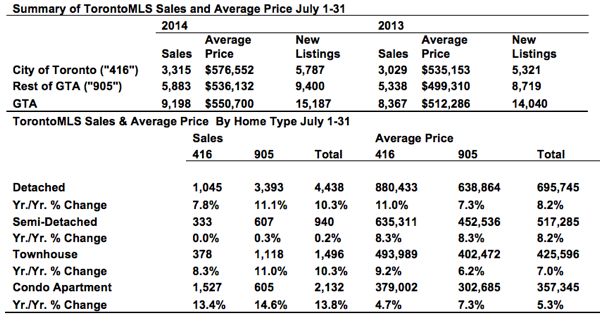

What happens when a seller receives 7 competing offers on their house, only to reject them all and then relist the next day at a much higher price? Following is TREB’s market report for July 2014.

Following is TREB’s market report for July 2014.

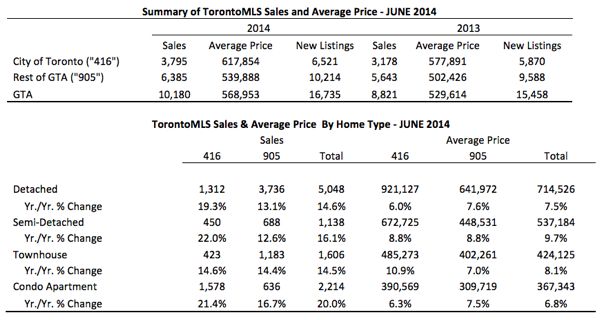

Following is TREB’s market report for June 2014.

Following is TREB’s market report for June 2014.

There are companies out there that specialize in sign installations for real estate agents.

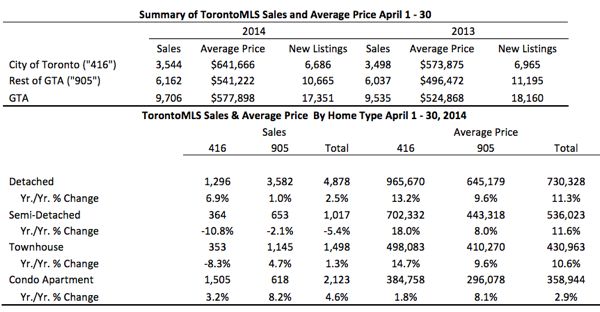

There are companies out there that specialize in sign installations for real estate agents. Following is TREB’s market report for April 2014.

Following is TREB’s market report for April 2014.

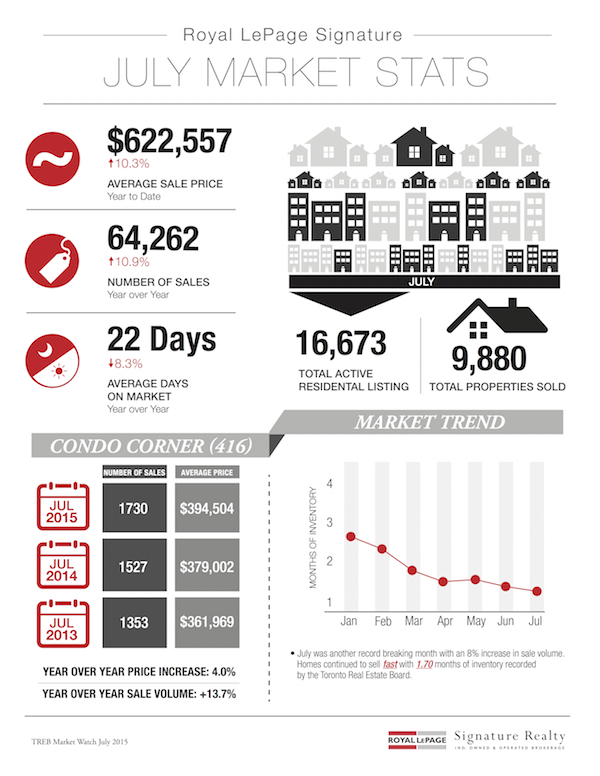

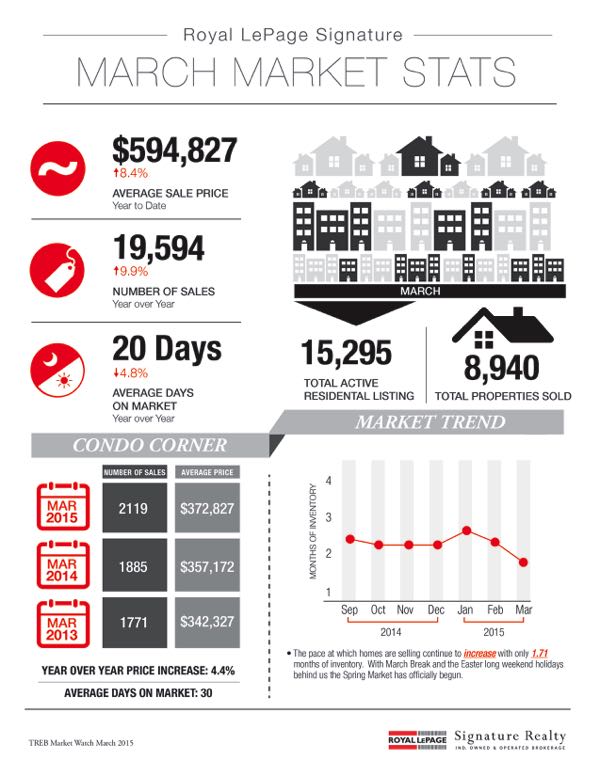

I've mentioned in previous blog posts that the spring market shifts into its highest gear right after the Easter long weekend (read those posts

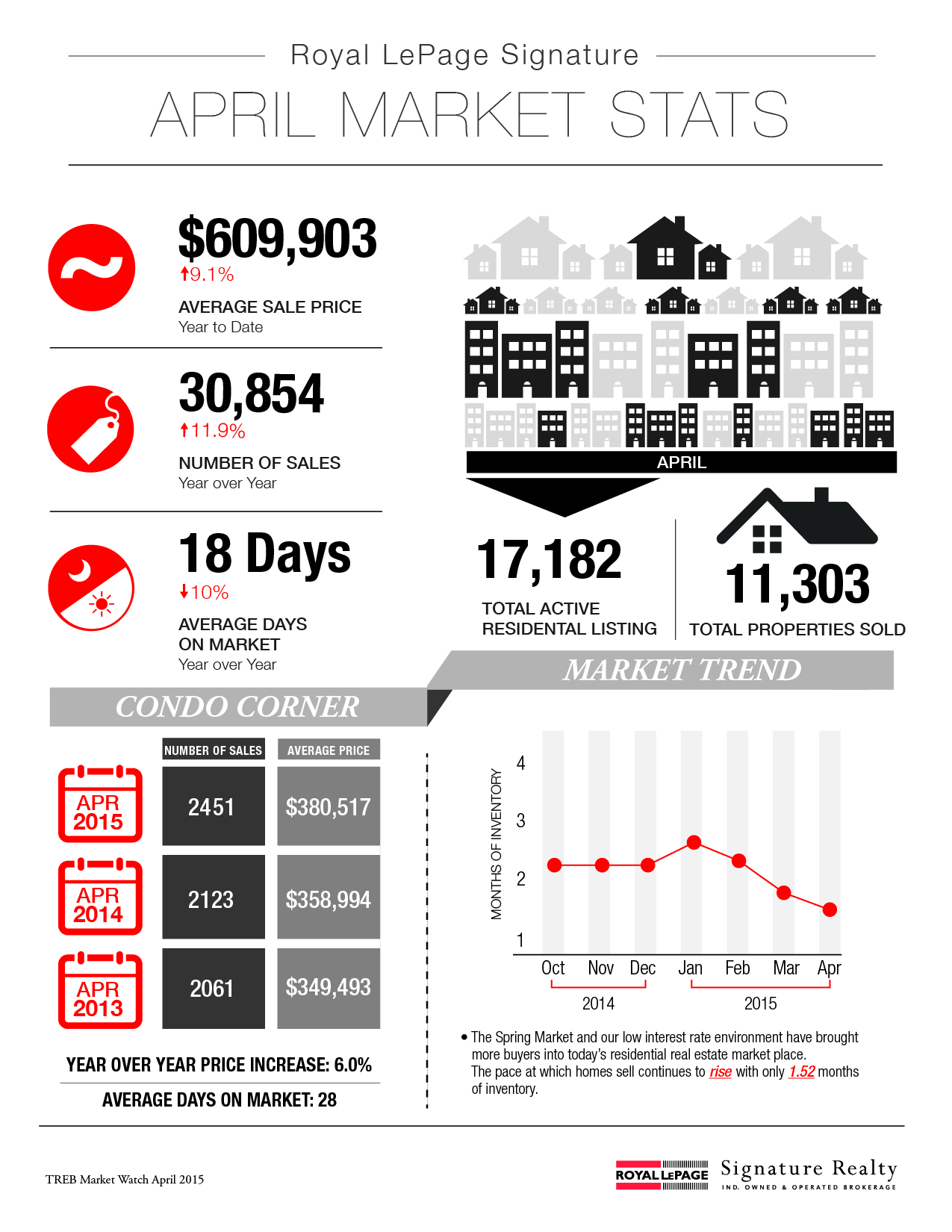

I've mentioned in previous blog posts that the spring market shifts into its highest gear right after the Easter long weekend (read those posts  Following is TREB’s market report for March 2014.

Following is TREB’s market report for March 2014.