As a realtor, I have access to up-to-the minute updates on mls. And I'm checking-in periodically throughout the day, scanning the hot listings for anything that might be a good match for my buyer clients.

As a realtor, I have access to up-to-the minute updates on mls. And I'm checking-in periodically throughout the day, scanning the hot listings for anything that might be a good match for my buyer clients.

Additionally, I have all of my clients set-up to receive daily automated emails with any new listings that hit the market the day before. For example, they receive an email early Tuesday morning with listings that were posted between 12:00am and 11:59pm on Monday.

So, regardless of whether or not I forward a specific listing that looks good, they are still going to see a full list of everything that hits the market. This is a great way for them to get a sense of what's popping-up in their price range, and it provides context for when a really great listing does come along.

Of course, I'm not the only realtor who does this. Every morning, all over the city, buyers receive automated emails with links to new listings that were posted on MLS the previous day.

I'd say the majority of these automated emails arrive on Tuesdays, Wednesdays, and Thursdays. They arrive on Fridays as well, although this is less common.

What about Saturdays and Sundays?

Simply put, Saturdays and Sundays are less-than-ideal days to have your property reach the market.

By the time Saturday rolls around, buyers and realtors have already compiled their list of properties to view for the weekend. Anything that lands in their inbox on Sat/Sun is more likely to fall through the cracks.

The odds are just better that a buyer is going to see your newly listed home if it's put in front of them on a weekday.

Sifting through the MLS updates becomes a part of many buyers' Mon-Fri routine. They open the links in the morning at breakfast, then they connect with their realtor during the day to highlight the best of the bunch, then they run through them again at home later that night. It becomes ritual. A weekday ritual.

That's not to say that buyers aren't looking at listings on Saturdays and Sundays. Real estate is addictive and many buyers are plugged-in 24/7.

Generally though, weekends are spent on social obligations, trips away from the city, and running a week's worth of errands.

Not to mention that weekends are when a lot of buyers are actually out viewing properties!

Despite all of the above, sellers still list on Fridays and Saturdays (which means buyers see these listings on Saturdays and Sundays).

Why?

Why would a seller (and/or their realtor) actually choose to have their home pop up on a Saturday or Sunday?

Why would they choose to have their most valuable asset make its debut on a day when the least number of potential buyers are going to catch it?

I think there are probably two main reasons;

Some realtors struggle with the ins-and-outs of how to best market a home.

It's no mistake that a lot of the listings I see pop up on Sat/Sun are also the ones that have crappy photos...

Some realtors are afraid that waiting a few more days to list will also be giving the seller a few more days to possibly change their mind.

Sad but true. Some realtors have been burned in the past and they think, "Hey, I need to get this place under contract and listed IMMEDIATELY, whether or not it's what's best for the seller."

I think there's a third reason to consider as well. It's possible that, despite their realtor's advice, some sellers are in a position where they need/want their home on the market ASAP. "Saturday, Sunday, Christmas Eve, New Year's Day... doesn't matter. We need it on the market NOW."

And what's a realtor to do in that situation? Of course they're going to list the property. They've given their best advice and now they're going to follow their client's directions.

For those sellers who have the option of waiting just a few more days though, listing on a weekday is almost always the way to go.

And if you're realtor is insisting that timing isn't crucially important to a successful listing, maybe it's time to find another realtor.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

"For a million bucks, we want a parking spot."

"For a million bucks, we want a parking spot."

When one thinks of iconic Toronto intersections, Yonge & Bloor undoubtedly comes to mind.

When one thinks of iconic Toronto intersections, Yonge & Bloor undoubtedly comes to mind.

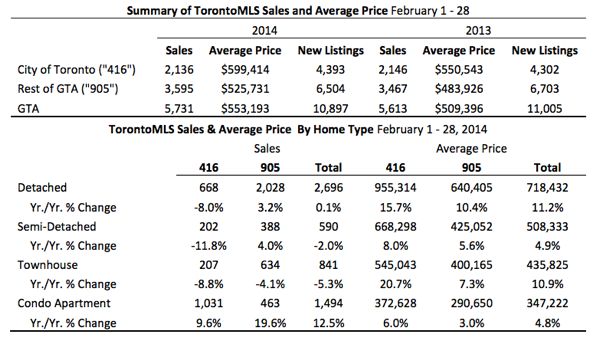

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

Earlier this week a gorgeous house popped up for sale in the west end.

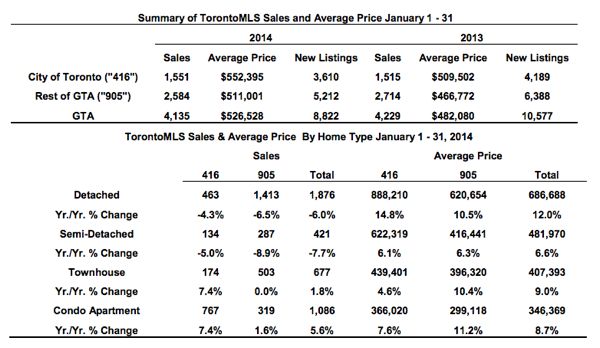

Earlier this week a gorgeous house popped up for sale in the west end. Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Depending on the building's location, a condo locker typically sells for $3,500 - $5,000 on the resale market.

Depending on the building's location, a condo locker typically sells for $3,500 - $5,000 on the resale market.

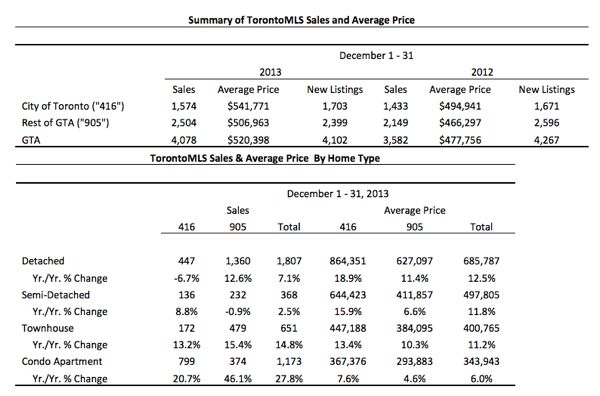

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

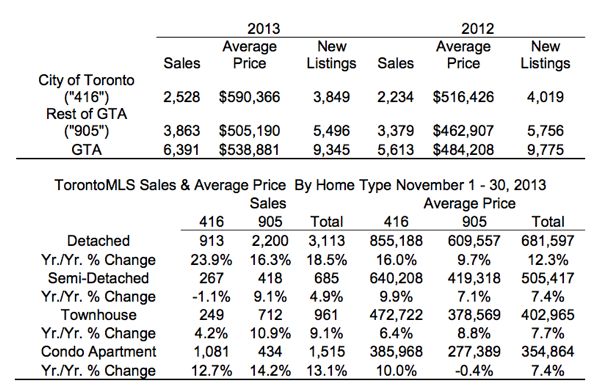

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

If you want to get the best price for your home, should you:

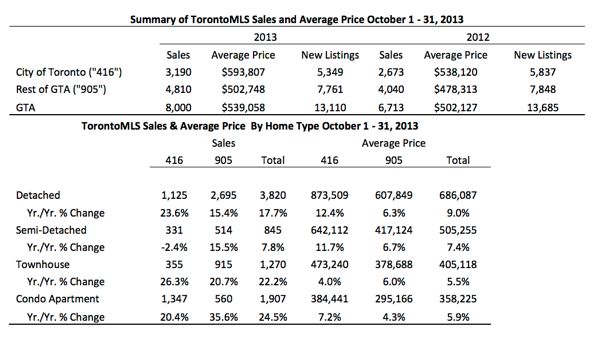

If you want to get the best price for your home, should you: Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

I was booking showings for a client the other day and one of the properties we wanted to see was restricting showings to Thursday evenings only, 6:00 - 9:00pm.

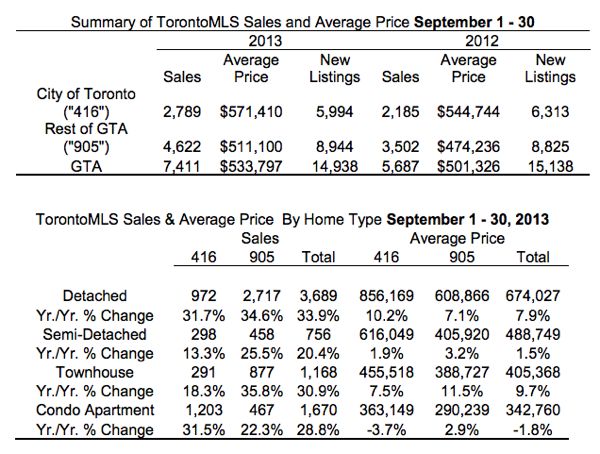

I was booking showings for a client the other day and one of the properties we wanted to see was restricting showings to Thursday evenings only, 6:00 - 9:00pm. Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Last weekend I held a couple of open houses at my new listing in the Massey Harris Lofts building on King Street West.

Last weekend I held a couple of open houses at my new listing in the Massey Harris Lofts building on King Street West. t

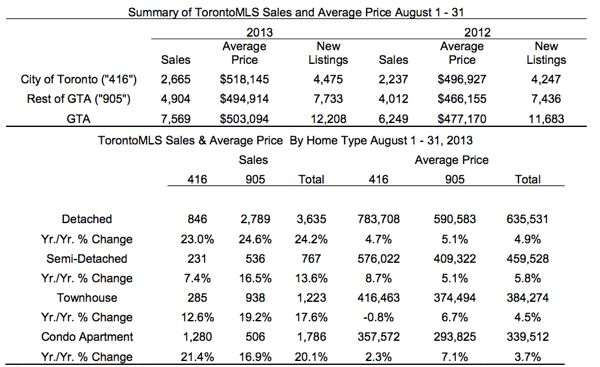

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

t

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

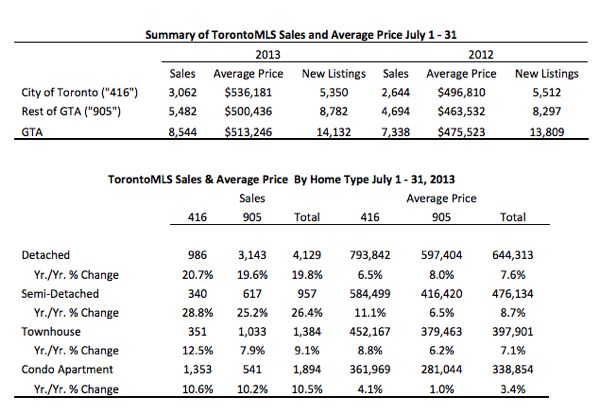

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

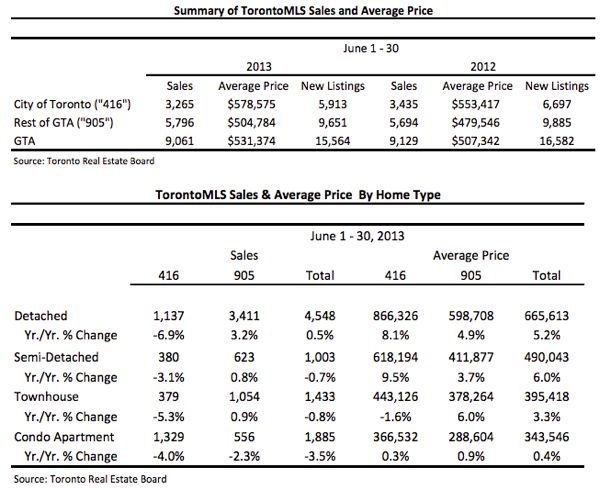

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

As a realtor, I have access to up-to-the minute updates on mls. And I'm checking-in periodically throughout the day, scanning the hot listings for anything that might be a good match for my buyer clients.

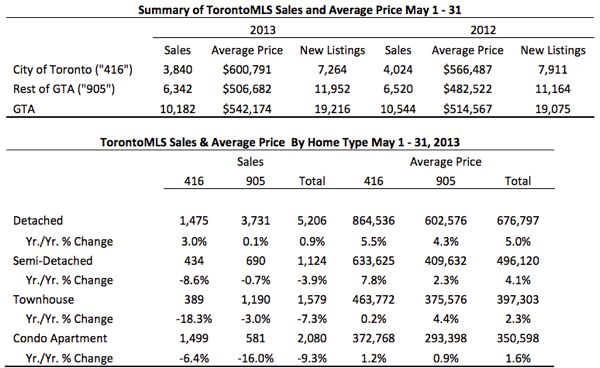

As a realtor, I have access to up-to-the minute updates on mls. And I'm checking-in periodically throughout the day, scanning the hot listings for anything that might be a good match for my buyer clients. Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

With so many new condo buildings popping up, great views are getting much harder to come by. Heck, even decent views are getting harder to come by.

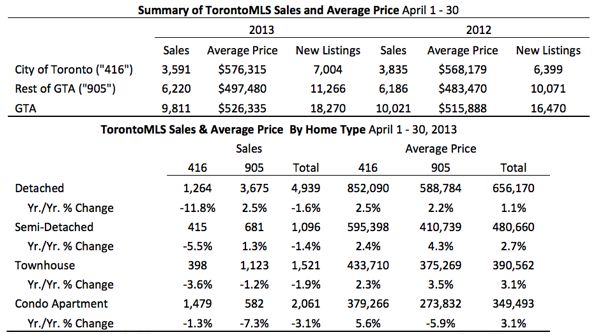

With so many new condo buildings popping up, great views are getting much harder to come by. Heck, even decent views are getting harder to come by. Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.

Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.