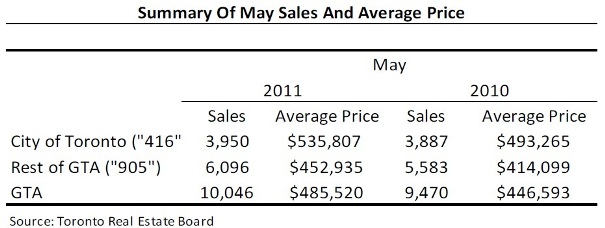

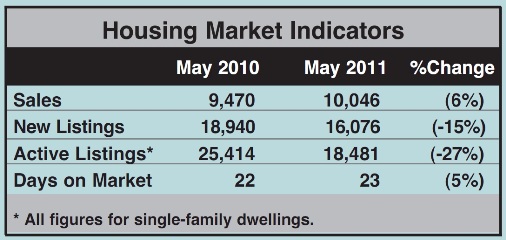

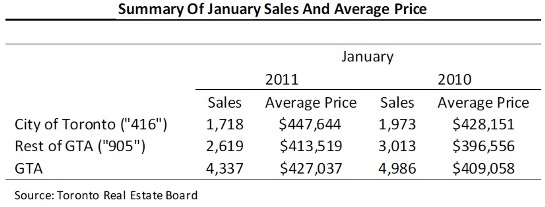

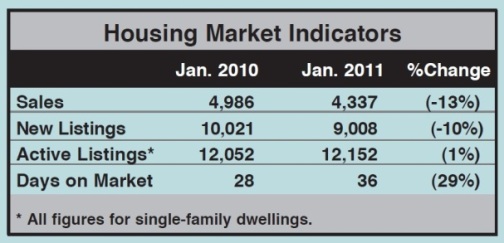

Following is TREB’s market report for May 2011: Greater Toronto REALTORS® reported 10,046 sales in May 2011 – up six per cent compared to May 2010. This result was the second best on record for May under the current Toronto Real Estate Board service area. The number of new listings in May, at 16,076, was down 15 percent compared to last year.

“Positive economic news and low borrowing costs led to strong sales through the first five months of the year, including the increase in May,” said Toronto Real Estate Board President Bill Johnston. “At the same time, the market has become much tighter compared to last year, due to a substantial dip in new listings.”

Homes were on the market for an average of 23 days and sold for an average price of $485,520– up nine per cent compared to $446,593 in May 2010. The strongest rate of price growth was experienced for single-detached homes sold in the City of Toronto.

“We have seen clear-cut seller’s market conditions emerge over the past two to three months,” explained Jason Mercer, TREB’s Senior Manager of Market Analysis. “The robust price appreciation that we have seen will hopefully prompt more households to list, resulting in a more balanced market later this year,” continued Mercer.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

Take a look at the above photo. This is how the Toronto Real Estate Board divides up the city. Furthermore, each of these four areas (Central, North, East, and West) are divided up into districts. For example, the Central area is divided up in Disticts C01, C02, C03... C15 (check out the photo below).

Take a look at the above photo. This is how the Toronto Real Estate Board divides up the city. Furthermore, each of these four areas (Central, North, East, and West) are divided up into districts. For example, the Central area is divided up in Disticts C01, C02, C03... C15 (check out the photo below).

Following is TREB's market report for mid-May 2011: Greater Toronto REALTORS® reported 4,774 sales through the TorontoMLS® during the first two weeks of May 2011. This result was two per cent lower than the May 2010 figure of 4,887.

Following is TREB's market report for mid-May 2011: Greater Toronto REALTORS® reported 4,774 sales through the TorontoMLS® during the first two weeks of May 2011. This result was two per cent lower than the May 2010 figure of 4,887.

Following is TREB's market report for mid-April 2011: Greater Toronto REALTORS® reported 4,444 sales during the first two weeks of April 2011 – a three per cent decrease compared to the first two weeks of April 2010. The number of new listings was down by 21 per cent compared to the same period last year.

Following is TREB's market report for mid-April 2011: Greater Toronto REALTORS® reported 4,444 sales during the first two weeks of April 2011 – a three per cent decrease compared to the first two weeks of April 2010. The number of new listings was down by 21 per cent compared to the same period last year.

Back in the fall I had a listing in one of the condo townhomes on Sudbury Street. That listing prompted me to write a full blog post on “The Appeal Of A Condo Townhouse” (read it

Back in the fall I had a listing in one of the condo townhomes on Sudbury Street. That listing prompted me to write a full blog post on “The Appeal Of A Condo Townhouse” (read it  It's roundup time! Let's take a look back at some of the more interesting articles, videos, and photos that popped up over the past two weeks...

It's roundup time! Let's take a look back at some of the more interesting articles, videos, and photos that popped up over the past two weeks...  On the 20th, Derek Flack of

On the 20th, Derek Flack of  On the 15th, Jessica Lemieux of

On the 15th, Jessica Lemieux of  On the 14th, Steve Ladurantaye of the

On the 14th, Steve Ladurantaye of the  On The 17th, Cliff Peskin of

On The 17th, Cliff Peskin of  On the 19th, Agatha Barc of

On the 19th, Agatha Barc of  Following is TREB's market report for mid-March 2011: Greater Toronto REALTORS® reported 4,138 sales during the first two weeks of March 2011 – a five per cent decrease compared to the first two weeks of March 2010. The number of new listings also dipped – down by 15 per cent compared to the same period last year.

Following is TREB's market report for mid-March 2011: Greater Toronto REALTORS® reported 4,138 sales during the first two weeks of March 2011 – a five per cent decrease compared to the first two weeks of March 2010. The number of new listings also dipped – down by 15 per cent compared to the same period last year.

It's weekly roundup time! Let's take a look back at some of the more interesting articles, videos, and photos that popped up over the past seven days...

It's weekly roundup time! Let's take a look back at some of the more interesting articles, videos, and photos that popped up over the past seven days...  On Wednesday, Derek Flack of

On Wednesday, Derek Flack of  On Wednesday, business reporter Tony Wong of the

On Wednesday, business reporter Tony Wong of the  On Saturday, Agatha Barc of

On Saturday, Agatha Barc of  On Tuesday, Jamie Bradburn of

On Tuesday, Jamie Bradburn of  On Tuesday, Matthew Slutsky of

On Tuesday, Matthew Slutsky of

Following is TREB's market report for mid-February 2011: Greater Toronto REALTORS® reported 3,084 sales during the first two weeks of February 2011 – a 13 per cent decrease compared to the first two weeks of February 2010.

Following is TREB's market report for mid-February 2011: Greater Toronto REALTORS® reported 3,084 sales during the first two weeks of February 2011 – a 13 per cent decrease compared to the first two weeks of February 2010.

It's been almost a year since the Feds last tightened lending rules (you can read my BLOG post from last February

It's been almost a year since the Feds last tightened lending rules (you can read my BLOG post from last February

One of my favourite Real Estate blogs,

One of my favourite Real Estate blogs,