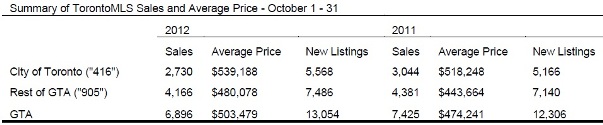

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

“Sales have decreased in the second half of this year compared to 2011, especially since the onset of stricter mortgage lending guidelines at the beginning of July. The prospect of higher monthly mortgage payments due to the reduced maximum amortization period has prompted some households to delay their home purchase,” said Toronto Real Estate Board (TREB) President Ann Hannah.

The average selling price for October transactions was $503,479 – up 6.2 per cent compared to October 2011. The MLS® Home Price Index composite benchmark price, which allows for an apples-to-apples comparison in terms of home attributes, was up by 5.1 per cent.

“We continue to see price increases well above the rate of inflation. Active listings have remained low from a historic perspective, so substantial competition between buyers still exists, especially for low-rise homes,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

“It should be noted, however, that the annual rate of price increase has been edging lower over the past few months as the market has gradually become better supplied,” continued Mercer.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

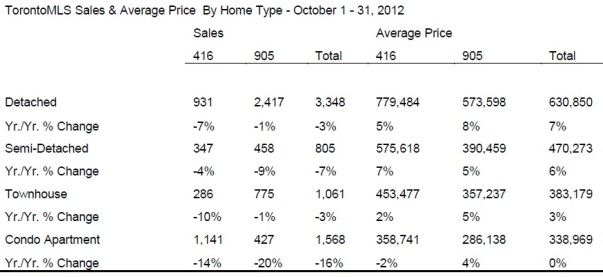

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.

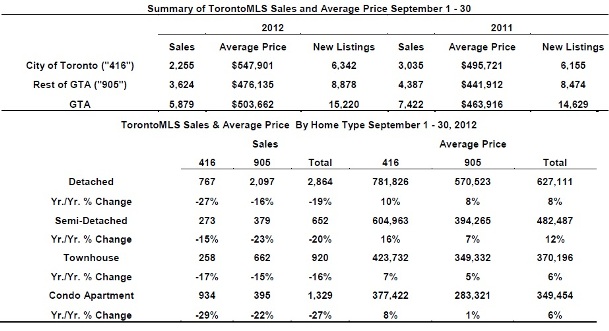

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

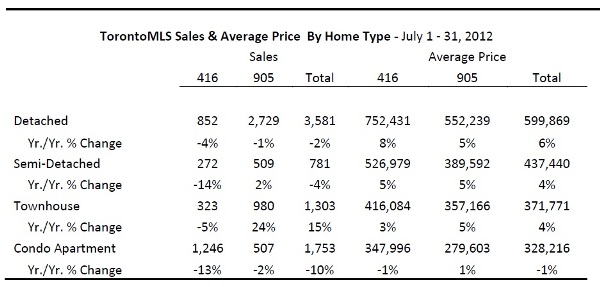

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

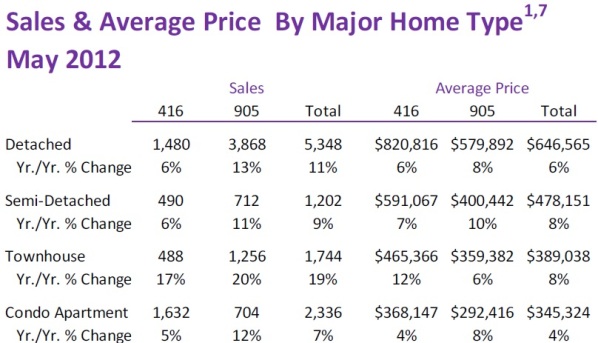

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

If you’re thinking of making a move and would like to know how I can help, feel free to

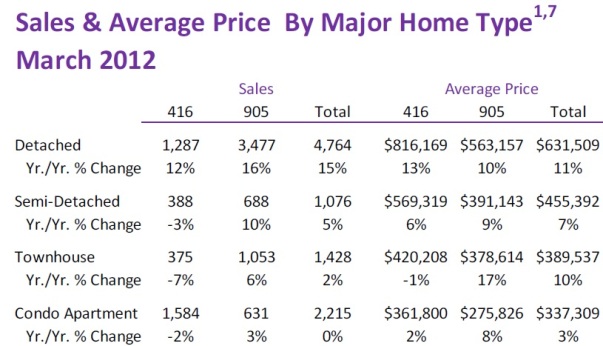

If you’re thinking of making a move and would like to know how I can help, feel free to  Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

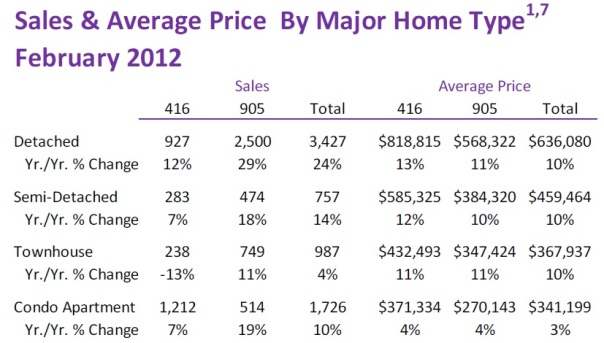

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

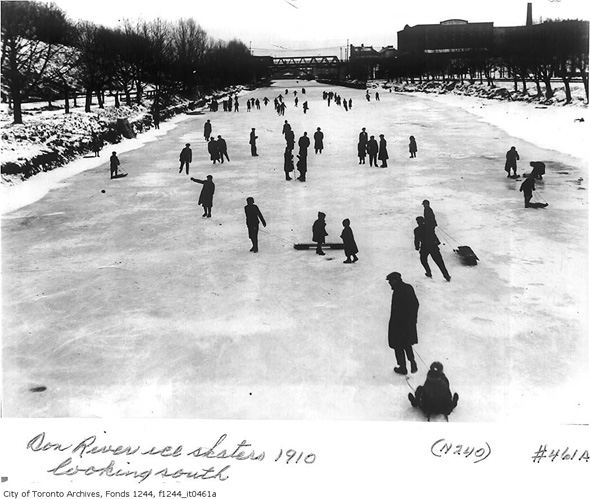

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks...

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks... On December 28th, the folks over at

On December 28th, the folks over at

On January 4th, Dereck Flack of

On January 4th, Dereck Flack of  On December 19th, Stephen Michalowicz of

On December 19th, Stephen Michalowicz of  On December 15th, the

On December 15th, the  On December 15th, Tristin Hopper of the

On December 15th, Tristin Hopper of the

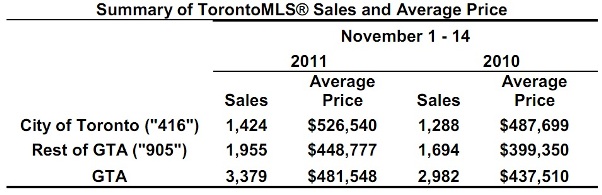

Following is TREB’s market report for mid-November 2011: Greater Toronto REALTORS® reported 3,379 transactions through the TorontoMLS® during the first two weeks of November. This result represented more than a 13 per cent increase compared to November 2010. New listings were up 16 per cent over the same period.

Following is TREB’s market report for mid-November 2011: Greater Toronto REALTORS® reported 3,379 transactions through the TorontoMLS® during the first two weeks of November. This result represented more than a 13 per cent increase compared to November 2010. New listings were up 16 per cent over the same period.

Following is TREB’s market report for mid-October 2011: Greater Toronto REALTORS® reported 3,477 transactions through the TorontoMLS® system during the first 14 days of October 2011. This total represented a 20 per cent increase over 2,890 sales reported during the first two weeks of October 2010. Year-over-year growth in new listings for the same period was slightly stronger than that recorded for sales – up 21 per cent to 6,249.

Following is TREB’s market report for mid-October 2011: Greater Toronto REALTORS® reported 3,477 transactions through the TorontoMLS® system during the first 14 days of October 2011. This total represented a 20 per cent increase over 2,890 sales reported during the first two weeks of October 2010. Year-over-year growth in new listings for the same period was slightly stronger than that recorded for sales – up 21 per cent to 6,249.

Following is TREB’s market report for mid-September 2011: Greater Toronto REALTORS® reported 3,149 transactions during the first 14 days of September, representing an increase of more than 25 per cent in comparison to the first two weeks of September 2010. New listings over the same period, at 6,890, were up by 14 per cent compared to last year.

Following is TREB’s market report for mid-September 2011: Greater Toronto REALTORS® reported 3,149 transactions during the first 14 days of September, representing an increase of more than 25 per cent in comparison to the first two weeks of September 2010. New listings over the same period, at 6,890, were up by 14 per cent compared to last year.