That's right. A bungalow in north Toronto sold earlier this month for $421,800 over the asking price. The home was listed at $759,000 and sold in multiple offers for a whopping $1,180,800.

That's right. A bungalow in north Toronto sold earlier this month for $421,800 over the asking price. The home was listed at $759,000 and sold in multiple offers for a whopping $1,180,800.

According to an article from today's CBC News (reposted in full, below), there were a total of five bids above $1 million dollars. This tells us that the successful purchaser wasn't alone in their seven figure valuation of the property.

Needless to say, there's been plenty of attention from the media, realtors, and the home buying public over the last few weeks.

The price isn't the only reason this story is generating so much hoopla though. The location and style of the home are notable as well.

Remember, we're talking about a bungalow... in north Toronto...

Would the reaction have been as strong if this was a 3-storey detached in The Beach? Or a mansion in the Annex?

Or what about Queen West? A colleague of mine just listed a stunning million dollar property there. I popped into the agent's open house today and the place really is impressive - something right out of Architectural Digest. Now that is the kind of property (and location) that could sell for a significant price without all the accompanying hullabaloo.

Okay, we've looked at price, location, and style of home. From what other angle can we view this north-Toronto bungalow sale? How about the type of buyer involved in the purchase? That's the focus of today's CBC News article. Check it out...

-----------------------------------------------------------

Offshore Buyers Pricing Canadians out of Housing Market

Globe & Mail | By Prithi Yeljaj | March 15, 2012

Overseas investors are snapping up properties in Canada's largest cities, driving up prices and pushing ordinary Canadians out of the housing market, observers say.

Real estate experts call it the "new reality," and the high price paid for a north Toronto bungalow is the latest evidence.

This month, the three-bedroom bungalow, circa the 1960s and without much updating, sold for $421,800 over the asking price, creating a buzz among agents and other buyers.

Located in Willowdale, where similar detached houses typically sell for just short of $900,000, the bungalow at 300 Dudley Ave. was listed at $759,000.

The winning bid of $1,180,800 came from a university student whose parents live in China and own a business in San Francisco. There were four other bids of more than $1 million.

Michael Adelson represented the seller of the Willowdale bungalow.

"The initial response was quite vociferous," said Michael Adelson, a Re/Max agent who represented the seller and received several phone calls about the deal after it was done.

"There's a lot of anger among Canadians who earn money here that they've been priced out of the market. There is some degree of anxiety about how people are going to compete with these hyper-inflated prices."

'Outrageous and borderline bizarre'

Adelson declined to discuss the specifics of the Willowdale deal, citing client confidentiality.

But CBC business commentator Michael Hlinka called the deal "outrageous and borderline bizarre."

The strong reaction to the price likely stems from how it changes the vision of affordability for average Canadians, he said.

Property markets in other large cities, such as Vancouver and Calgary, are undergoing similar pricing shocks, he said.

“We’re looking at this through a prism of our expectations growing up in Canada in the 1950s, '60s and '70s, when part of the Canadian dream was that you would own your own single-family home," Hlinka said. "But as Canada matures, we’re going to be looking at a new reality, where that may be out of reach. And I don’t think you can turn back the clock.”

Brad Lamb says people who live in downtown Toronto will have to be rich or settle for condos. (Brad Lamb Real Estate)

Toronto real estate mogul Brad Lamb said Canadians' home-buying expectations have to change, but he doesn't believe that overseas investors are to blame.

The scarcity of the product — in this case, single detached homes — is key, he said. And as the Toronto population grows and land available for new houses becomes scarce, the competition for these homes will become even more intense.

Condos are the alternative. Already, they're the norm for families wanting to live in the central cores of cities such as New York and Chicago, he said.

"It's an illusion for people to think they can live in downtown Toronto in a detached home and not be wealthy," Lamb said. "Ordinary people can't live in central London or central Paris or central New York.

"If you want to live in central Toronto, you're going to have to live in a condo or be a millionaire. That's the reality. ... It's not a bad thing. It's the way cities evolve."

Steve Matthews, a Re/Max agent in Toronto, says inflated prices make it harder for ordinary Canadians to buy houses. (Steve Matthews)

Inflated prices, such as the price fetched by the Willowdale bungalow, do make it difficult for ordinary Canadians to get into the market, no matter who buys the house, said Steve Matthews, a Re/Max agent in north Toronto.

"It skews the market. Now, the person who lives next door and the person who lives down the street think they should get that price, too. It also generates resentment because it makes it tougher for everyone — buyers, agents, banks — so there is a ripple effect that goes beyond the immediate sale."

Foreign students drive market

As more people get exposure to Canada as an offshoot of globalization, the overseas investor market will rise, Hlinka said. As an instructor at George Brown College in Toronto, he has seen an explosion in the number of foreign students.

“When their parents come to visit, they get an idea of what real estate costs here, and they can’t believe how cheap it is. They want to buy because they think it’s a bargain.”

In addition to China, investors pouring money into real estate are flocking to Canada from the Middle East, Korea, Russia, India and the Philippines as well, said Tony Ma, who owns HomeLife Landmark Realty in Markham.

Tony Ma, owner of HomeLife Landmark realty, says buyers from China find Canadian housing prices low, compared with what they pay at home. (Tony Ma)

About 65 per cent of Ma’s agents are Chinese and the bulk of his business comes from Chinese clients. Most are new immigrants to Canada, but about 20 per cent are foreign investors, including parents overseas who buy on behalf of their children studying in this country.

Fewer than five per cent are pure investors with no ties to Canada, said Ma, a former neurosurgeon who moved to Toronto from Zhengzhou, China, in 1998.

"Most of our buyers are part of Canadian culture. I don’t think they are going to push local Canadian people out of the market. When immigrants come to Canada today, they have money, not like when I came to Canada 20 years ago. I didn’t have money."

Last year, buoyed by his strong ties to the mainland China market, Ma’s agency sold 263 homes priced at more than $1 million, with about 40 per cent of those being all-cash deals with no conditions attached.

Chinese drawn to Canada

Canada’s stable government and banking system and the relatively low prices draw investors, he said, pointing out that while condos in downtown Toronto can sell for $800 per square foot, in Beijing, the price is $2,000 per square foot and in Hong Kong it's double that.

Moreover, to control prices, the Chinese government allows each family there to bank finance only two properties — one to live in and one to invest in — and buyers must pay 100 per cent cash for anything above the two-property limit, Ma said.

Not only are prices in Canada more affordable, homes and condos are a better value proposition, since they come ready to move into, unlike in China, where buyers get a concrete shell they have to pay to finish, he said.

“So they see an $8 million house here, they see the quality, they see the finishes and they think it’s cheap," Ma said. "They can move in today.”

Vancouver tops the list with Chinese investors because of the city’s temperate climate and proximity to their homeland, he added.

Janet Sinclair of Re/Max Hallmark Realty Ltd. in the Beaches neighbourhood of Toronto, routinely deals with foreign investors.

“They have driven prices up," she said. "Whenever we launch a new condo downtown we get a number of Hong Kong investors and a lot of people coming over from England. People want to put their money in Canadian real estate because they think it’s safe.”

Sinclair recently dealt with a Hong Kong investor representing a dozen buyers, who happened to be family members from back home. They snapped up units in a new waterfront condo building and are now interested in another project in the Beaches.

She also recently sold a penthouse condo in downtown Toronto to Swiss investors for $1.25 million.

“They didn’t bat an eye at the price. They said in comparison to what they pay in Switzerland, these prices are nothing. Our prices are not scaring them at all."

Builders tearing down old houses

The Willowdale buyer who paid the premium price is stinging from the negative reaction to the sale and declined to be interviewed.

Adelson said the Yonge Street corridor between Highway 401 and Finch Avenue is in demand because of the subway and its proximity to York University and Seneca College. Along with a thriving retail strip and a planned new Whole Foods, 10 new condominium projects are in the works.

The area is a magnet for certain ethnic groups, including people from the Middle East and China, Adelson said.

"It's a cultural thing. Their communities are already there. If you go down to the Danforth, their stores are not there, so that's not as attractive a location for them."

The area is also rife with redevelopment as builders tear down older homes and replace them with monster houses or two smaller units.

That’s just what a buyer from China, who recently bought a tear-down bungalow in the area for $720,000, plans to do, said Al Sinclair, the Hallmark Realty sales representative who sold him the property.

The buyer became familiar with the area through visiting his daughter, a doctor who lives there. He plans to rent out the house for two years until his building plans are approved, then tear it down and build several townhouse units.

“He thinks the Toronto real estate market has a long way to go," Sinclair said. "He’s right."

Only pockets of Toronto are of interest to overseas investors, including North York and the downtown core and not areas like Leslieville in the east end, Adelson said. Although that neighbourhood is considererd hot and the property values are rising, it has not experienced the overheated bidding wars seen farther north.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

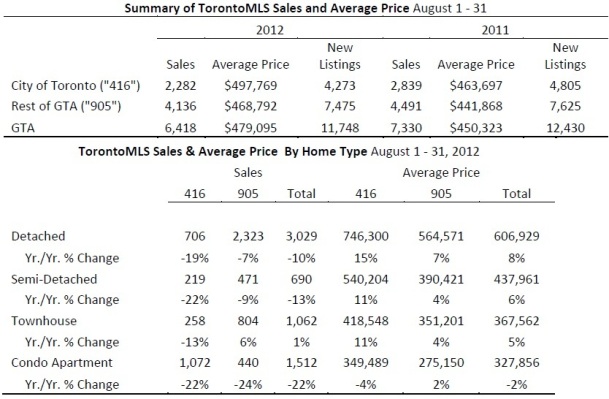

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

The last few weeks in August are similar to the last few weeks in December in that these are the two times of year when a relatively large portion of the real estate market (buyers, sellers, and realtors) are away on vacation.

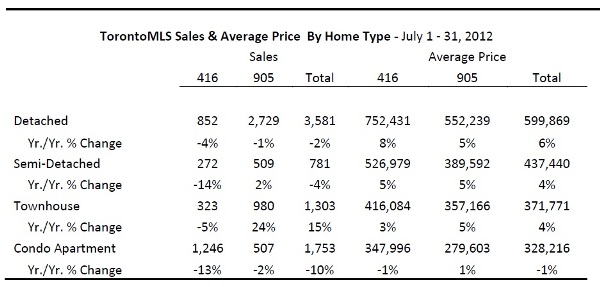

The last few weeks in August are similar to the last few weeks in December in that these are the two times of year when a relatively large portion of the real estate market (buyers, sellers, and realtors) are away on vacation. Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

There’s been a lot of talk over the last few weeks about how many buyers out there are actually going to feel the sting of the new mortgage rules that came into effect on July 9th. While the media has been playing up the severity of the implications these new rules bring, most industry insiders feel that only a relative minority of purchasers will actually have their buying power significantly reduced.

There’s been a lot of talk over the last few weeks about how many buyers out there are actually going to feel the sting of the new mortgage rules that came into effect on July 9th. While the media has been playing up the severity of the implications these new rules bring, most industry insiders feel that only a relative minority of purchasers will actually have their buying power significantly reduced. Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

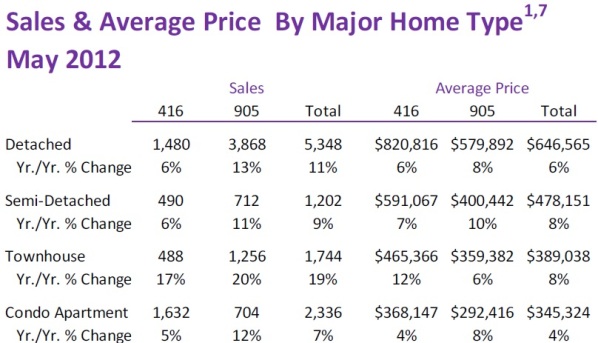

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

My wife and I have been known to watch a fair bit of television together. Although we share a love of many of the same shows (Twin Peaks, The Mighty Boosh, ...to name a few) our viewing habits are different. She’s happy to sit through marathon sessions of back-to-back-to-back episodes, whereas I like to spread mine out.

My wife and I have been known to watch a fair bit of television together. Although we share a love of many of the same shows (Twin Peaks, The Mighty Boosh, ...to name a few) our viewing habits are different. She’s happy to sit through marathon sessions of back-to-back-to-back episodes, whereas I like to spread mine out. Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

If you’re thinking of making a move and would like to know how I can help, feel free to

If you’re thinking of making a move and would like to know how I can help, feel free to  A couple of months ago I wrote a blog post asking the question, "Sellers: Should you have a pre-listing home inspection done?" (read it

A couple of months ago I wrote a blog post asking the question, "Sellers: Should you have a pre-listing home inspection done?" (read it  Two years ago I wrote a blog post asking the question, "When does the spring real estate market actually begin?"

Two years ago I wrote a blog post asking the question, "When does the spring real estate market actually begin?" Many feel that the spring market doesn't really begin until the month of March. There's some truth to this in the sense that March is generally when we start to see signs of warmer weather and buyers are more apt to tour the neighbourhood for open houses.

Many feel that the spring market doesn't really begin until the month of March. There's some truth to this in the sense that March is generally when we start to see signs of warmer weather and buyers are more apt to tour the neighbourhood for open houses. Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

I was viewing condos at Bathurst & Lakeshore earlier this week with a buyer client of mine. The plan was to see six properties in total, all located within two neighbouring buildings. We got in to see five of the properties, no problem. Unfortunately, condo number six - the one she really wanted to see - didn't go as smoothly...

I was viewing condos at Bathurst & Lakeshore earlier this week with a buyer client of mine. The plan was to see six properties in total, all located within two neighbouring buildings. We got in to see five of the properties, no problem. Unfortunately, condo number six - the one she really wanted to see - didn't go as smoothly... That's right. A bungalow in north Toronto sold earlier this month for $421,800 over the asking price. The home was listed at $759,000 and sold in multiple offers for a whopping $1,180,800.

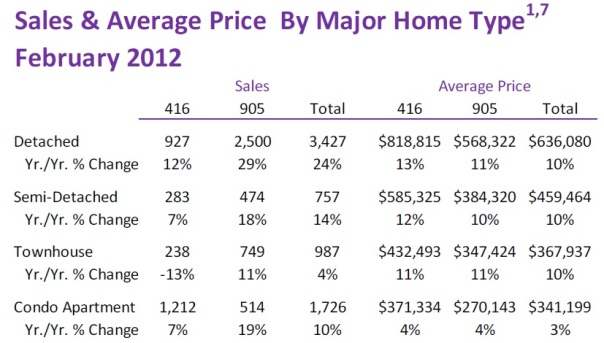

That's right. A bungalow in north Toronto sold earlier this month for $421,800 over the asking price. The home was listed at $759,000 and sold in multiple offers for a whopping $1,180,800. Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

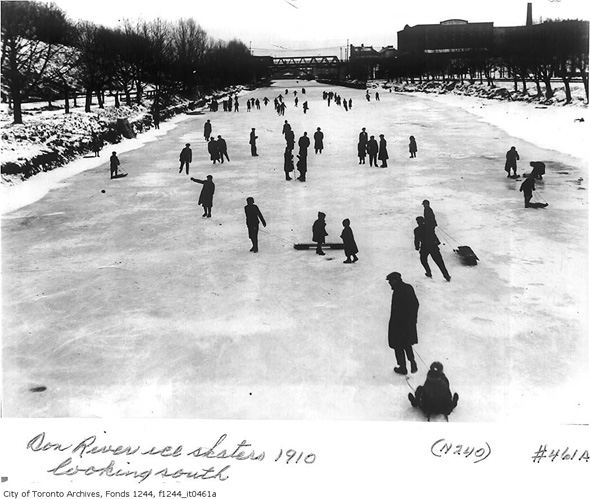

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks...

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks... On December 28th, the folks over at

On December 28th, the folks over at  On January 4th, Dereck Flack of

On January 4th, Dereck Flack of  On December 19th, Stephen Michalowicz of

On December 19th, Stephen Michalowicz of  On December 15th, the

On December 15th, the  On December 15th, Tristin Hopper of the

On December 15th, Tristin Hopper of the