What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

Anyone who's ever bought or sold a home is probably familiar with the vernacular. And no doubt anyone actively in the market right now is using the jargon on a regular basis. For anyone unfamiliar with the terminology and a bit curious, the Toronto Real Estate Board released an article last week detailing some of those more commonly used. Check it out...

Following is Bob Johnston's (TREB President) Column as it appears every Friday in the Toronto Sun’s Resale Homes and Condos section:

Coming To "Terms" With Real Estate

September 17th, 2010 --- From major league sports to the medical field, every profession has its own unique lingo and real estate is no exception. Since a home is likely to be the single largest purchase you will ever make, it’s worthwhile to have an understanding of some of the terms most commonly used in the real estate world.

There is a distinction between real estate practitioners and those who can use the certified “REALTOR®” trademark. While all real estate professionals are required to achieve registration with the provincial regulator, the Real Estate Council of Ontario (RECO), REALTORS® are those who also choose to belong to the Canadian Real Estate Association by joining a local board like the Toronto Real Estate Board. Boards operate MLS® under license from the Canadian Real Estate Association, and Members abide by the professional standards of business practice.

Using the MLS®, a REALTOR® can contrast your existing or prospective home with those recently sold in the area, developing a CMA or Comparative Market Analysis, to help you determine a suitable offer or listing price.

You may have noticed that some REALTORS® are Salespersons and others are Brokers. While all real estate professionals begin their careers as Salespersons, many choose to pursue RECO’s more advanced Broker designation after two years in practice.

A Broker of Record meanwhile, is an individual who is responsible for the operation of a real estate company, or brokerage. Salespersons and Brokers act on behalf of the brokerage and the Broker of Record is responsible for ensuring supervision of their activity.

When you work with a salesperson or broker, you will have the opportunity to determine whether you want to be represented as a Client or as a Customer.

By opting for Client status, you are choosing to contract with a real estate professional and the brokerage they represent, so that they will act in your best interest throughout the duration of your transaction.

By choosing Customer status, you have agreed that the real estate professional and their brokerage are not required to represent your interests and you are not obligated to work exclusively with them.

Once you have chosen to work with a REALTOR® you may choose to list your home on MLS® and may be presented with an array of marketing options, one of which can afford your listing heightened exposure by displaying it on the websites of other brokerages. This is referred to as IDX, or Internet Data Exchange.

When you peruse listings on REALTORS’® websites you will notice a number of abbreviations to describe a home’s features like elf – electrical light fixture, fp – fireplaces, and cac – central air conditioning.

These are just a handful of commonly used terms in the world of real estate. To learn more about the process of buying and selling a home talk to a REALTOR® and visit www.TorontoRealEstateBoard.com where you’ll find Greater Toronto Area listings, a schedule of upcoming open houses, plain language explanations of real estate forms and more.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

Following is TREB's market report for mid-November 2010: Greater Toronto REALTORS® reported 3,076 sales through the Multiple Listing Service® (MLS®) during the first two weeks of November 2010. This represented a 16 per cent decrease compared to the 3,666 sales recorded during the same period in November 2009. Year-to-date sales amounted to 78,526 – up slightly from the 2009 total.

Following is TREB's market report for mid-November 2010: Greater Toronto REALTORS® reported 3,076 sales through the Multiple Listing Service® (MLS®) during the first two weeks of November 2010. This represented a 16 per cent decrease compared to the 3,666 sales recorded during the same period in November 2009. Year-to-date sales amounted to 78,526 – up slightly from the 2009 total.

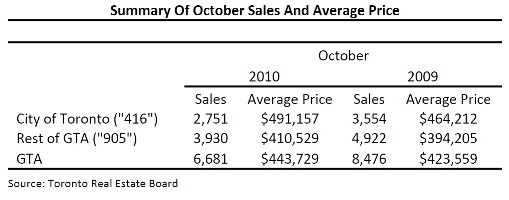

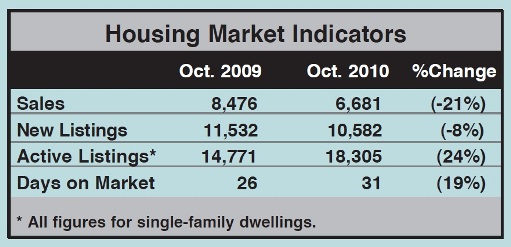

Following is TREB's market report for October 2010: Greater Toronto REALTORS® reported 6,681 sales through the Multiple Listing Service® (MLS®) in October 2010. This represented a 21 per cent decrease compared to the 8,476 sales recorded in October 2009. Through the first ten months of the year, sales amounted to 75,582 – up one per cent compared to the January through October period in 2009.

Following is TREB's market report for October 2010: Greater Toronto REALTORS® reported 6,681 sales through the Multiple Listing Service® (MLS®) in October 2010. This represented a 21 per cent decrease compared to the 8,476 sales recorded in October 2009. Through the first ten months of the year, sales amounted to 75,582 – up one per cent compared to the January through October period in 2009.

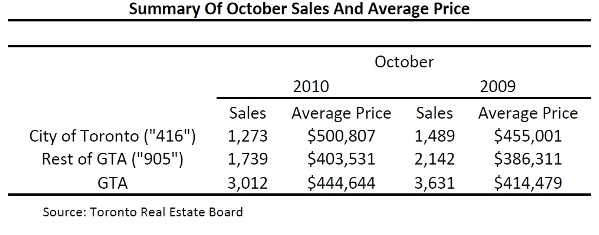

Following is TREB's market report for mid-October 2010: Greater Toronto REALTORS® reported 3,012 sales through the Multiple Listing Service® (MLS®) during the first two weeks of October 2010. This represented a 17 per cent decrease compared to the 3,631 sales recorded during the same period in 2009. Year-to-date sales amounted to 71,988, representing a three per cent increase compared to 2009.

Following is TREB's market report for mid-October 2010: Greater Toronto REALTORS® reported 3,012 sales through the Multiple Listing Service® (MLS®) during the first two weeks of October 2010. This represented a 17 per cent decrease compared to the 3,631 sales recorded during the same period in 2009. Year-to-date sales amounted to 71,988, representing a three per cent increase compared to 2009.

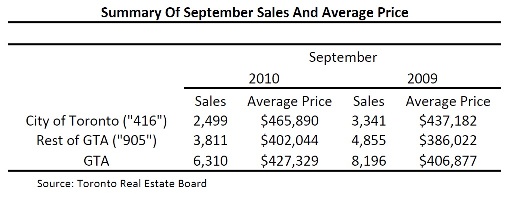

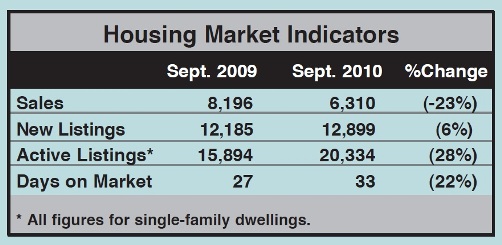

Following is TREB's market report for September 2010: Greater Toronto REALTORS® reported 6,310 sales through the Multiple Listing Service® (MLS®) in September 2010. This represented a 23 per cent decrease compared to the 8,196 sales recorded during the same period in 2009. Through the first nine months of the year, sales amounted to 69,069 – up four per cent compared to the first three quarters of 2009.

Following is TREB's market report for September 2010: Greater Toronto REALTORS® reported 6,310 sales through the Multiple Listing Service® (MLS®) in September 2010. This represented a 23 per cent decrease compared to the 8,196 sales recorded during the same period in 2009. Through the first nine months of the year, sales amounted to 69,069 – up four per cent compared to the first three quarters of 2009.

What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

Following is TREB's market report for mid-September 2010: Greater Toronto REALTORS® reported 2,623 sales through the Multiple Listing Service® (MLS®) during the first two weeks of September 2010. This represented a 22 per cent decrease compared to the 3,361 sales recorded during the same period in 2009. Year-to-date sales amounted to 65,455, representing a six per cent increase compared to 2009.

Following is TREB's market report for mid-September 2010: Greater Toronto REALTORS® reported 2,623 sales through the Multiple Listing Service® (MLS®) during the first two weeks of September 2010. This represented a 22 per cent decrease compared to the 3,361 sales recorded during the same period in 2009. Year-to-date sales amounted to 65,455, representing a six per cent increase compared to 2009.

On Tuesday I helped a client of mine purchase a great 2 bedroom + den/2 bathroom condo in

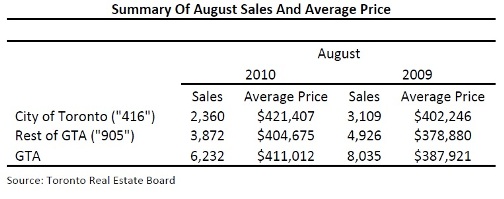

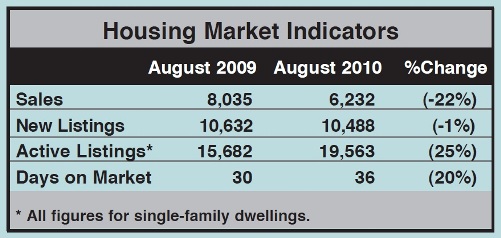

On Tuesday I helped a client of mine purchase a great 2 bedroom + den/2 bathroom condo in  Greater Toronto REALTORS® reported 6,232 sales through the Multiple Listing Service® (MLS®) in August 2010. This represented a 22 per cent decrease compared to the 8,035 sales recorded during the same period in 2009. New listings decreased by one per cent year-over-year to 10,488.

Greater Toronto REALTORS® reported 6,232 sales through the Multiple Listing Service® (MLS®) in August 2010. This represented a 22 per cent decrease compared to the 8,035 sales recorded during the same period in 2009. New listings decreased by one per cent year-over-year to 10,488.

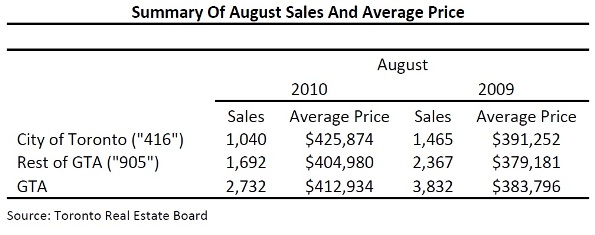

Greater Toronto REALTORS® reported 2,732 sales through the Multiple Listing Service® (MLS®) during the first two weeks of August 2010. This represented a 29 per cent decrease compared to the 3,832 sales recorded during the same period in 2009. New listings, at 4,770 were down eight per cent compared to the first two weeks of August 2009.

Greater Toronto REALTORS® reported 2,732 sales through the Multiple Listing Service® (MLS®) during the first two weeks of August 2010. This represented a 29 per cent decrease compared to the 3,832 sales recorded during the same period in 2009. New listings, at 4,770 were down eight per cent compared to the first two weeks of August 2009.

Like anyone else, I've celebrated my share of milestones over the years. Kindergarten graduation, my first kiss, marriage, buying my first home... This week I'm proud add one more thing to the list - my real estate Blog is now one year old!

Like anyone else, I've celebrated my share of milestones over the years. Kindergarten graduation, my first kiss, marriage, buying my first home... This week I'm proud add one more thing to the list - my real estate Blog is now one year old!

In the Toronto real estate market, tenanted properties come up for sale all the time. Listings for houses with basement tenants, for example, are quite common. And there’s certainly no shortage of renter-occupied condos for sale. There’s one very important distinguishing question for the potential buyer of such a property though, “Can I take vacant possession or do I have to assume the tenant?”

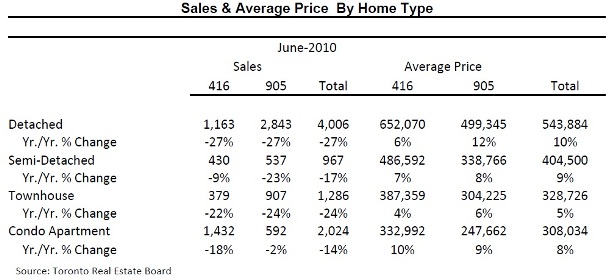

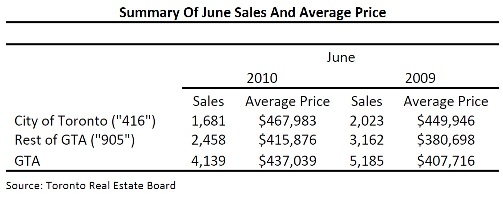

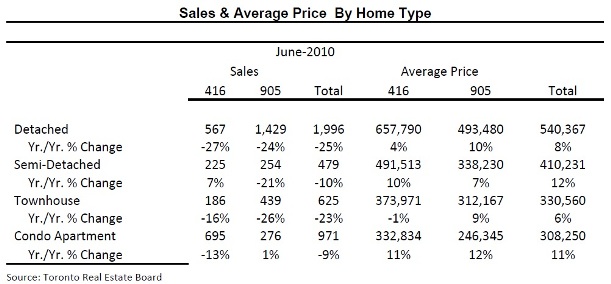

In the Toronto real estate market, tenanted properties come up for sale all the time. Listings for houses with basement tenants, for example, are quite common. And there’s certainly no shortage of renter-occupied condos for sale. There’s one very important distinguishing question for the potential buyer of such a property though, “Can I take vacant possession or do I have to assume the tenant?” Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985...

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985...

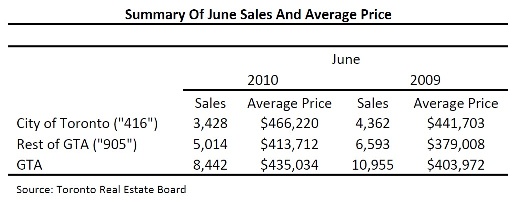

Greater Toronto REALTORS® reported 8,442 sales through the Multiple Listing Service® (MLS®) in June. This represented a 23 per cent decrease compared to the record 10,955 sales reported in June 2009. Sales for the second quarter of 2010 amounted to 28,810 – up one percent annually. Year-to-date sales through June were up 23 per cent to 50,455compared to the first six months of 2009.

Greater Toronto REALTORS® reported 8,442 sales through the Multiple Listing Service® (MLS®) in June. This represented a 23 per cent decrease compared to the record 10,955 sales reported in June 2009. Sales for the second quarter of 2010 amounted to 28,810 – up one percent annually. Year-to-date sales through June were up 23 per cent to 50,455compared to the first six months of 2009.

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985.

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985.

I was recently speaking with a couple of friends who are thinking of selling their condo and moving into something bigger. "We're hearing that prices are cooling off - should we wait awhile before making a move?" Good question. Unfortunately, there isn't one catch-all answer.

I was recently speaking with a couple of friends who are thinking of selling their condo and moving into something bigger. "We're hearing that prices are cooling off - should we wait awhile before making a move?" Good question. Unfortunately, there isn't one catch-all answer.