Following is TREB’s market report for December 2014:

Following is TREB’s market report for December 2014:

Toronto Real Estate Board President Paul Etherington announced that Greater Toronto REALTORS® reported 92,867 residential sales through the TorontoMLS system in 2014, including 4,446 in December.

The calendar year 2014 sales result represented a 6.7 per cent increase over the 2013 sales figure of 87,049 and was just short of the record set in 2007.

"TREB's 2014 sales figures are a testament to the importance Greater Toronto Area households continue to place on home ownership.

GTA households realize that home purchases have been a quality long-term investment.

While home prices certainly increased substantially in 2014, the purchase of an average priced home remained affordable, in terms of the average household's ability to comfortably cover their monthly mortgage payments," said Mr. Etherington.

"Even with a constrained supply of homes for sale in many parts of the Greater Toronto Area, buyers continued to get deals done last month.

Households remain upbeat about home ownership because monthly mortgage payments remain affordable relative to accepted lending standards.

This is coupled with the fact that housing has proven to be a quality long-term investment," stated Mr. Etherington.

The average selling price continued to grow on a year-over-year basis in calendar year 2014, with an 8.4 per cent increase over calendar year 2013 to $566,726.

This included a seven per cent increase in the December 2014 average selling price to $556,602.

Throughout 2014, annual increases in the average selling price and the MLS® HPI Composite Benchmark were consistently reported on a monthly basis for most market segments, from detached homes through to condominium apartments.

"The strong price growth we experienced in 2014 can be explained with two words: listings shortage.

The constrained supply of listings was especially evident for low-rise home types like singles, semis and town houses.

The number of households looking to purchase these home types increased, while the number of homes from which they could choose decreased.

This situation resulted in more competition between buyers and more aggressive offers," said Jason Mercer, TREB's Director of Market Analysis.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

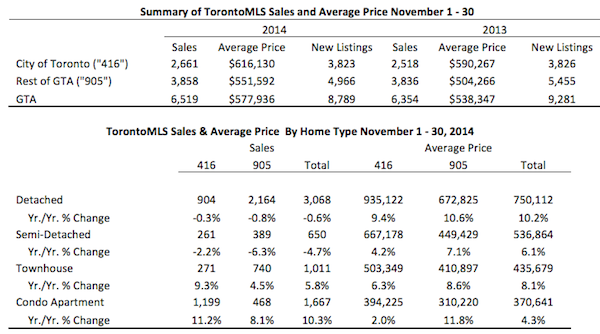

Following is TREB’s market report for November 2014:

Following is TREB’s market report for November 2014:

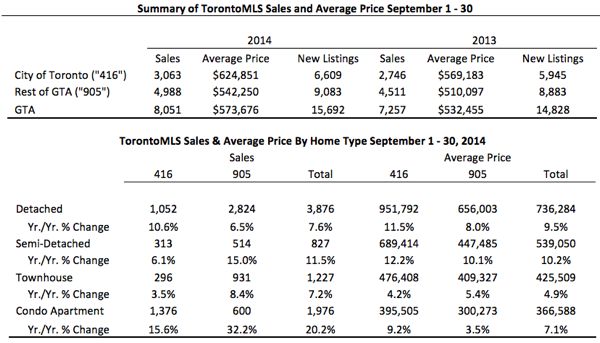

Following is TREB’s market report for September 2014:

Following is TREB’s market report for September 2014:

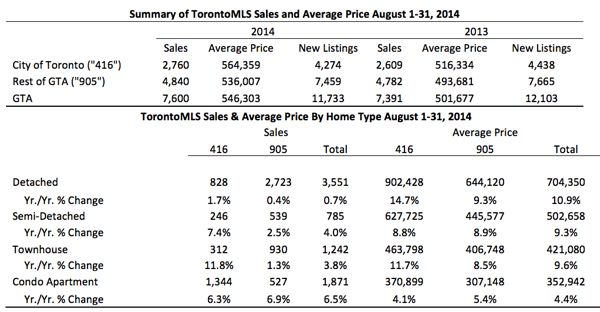

Following is TREB’s market report for August 2014:

Following is TREB’s market report for August 2014:

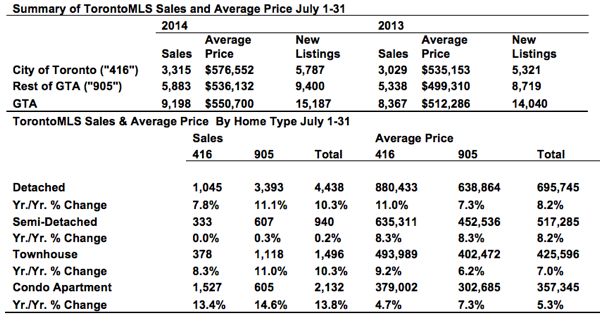

Following is TREB’s market report for July 2014.

Following is TREB’s market report for July 2014.

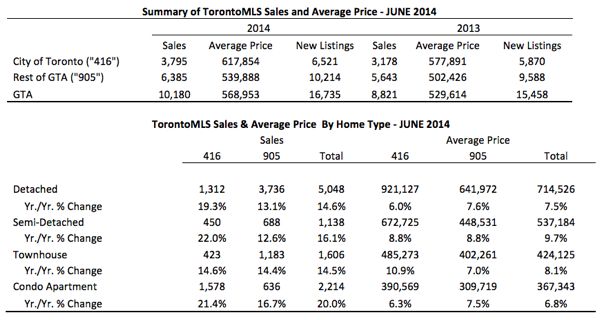

Following is TREB’s market report for June 2014.

Following is TREB’s market report for June 2014.

There are companies out there that specialize in sign installations for real estate agents.

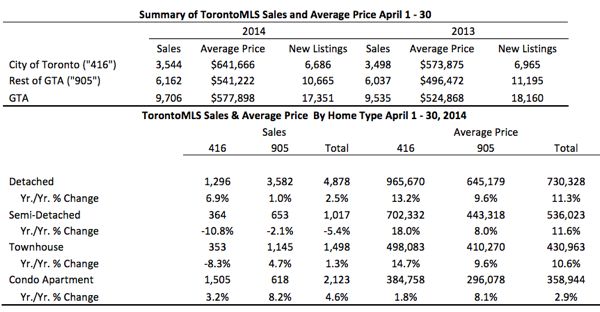

There are companies out there that specialize in sign installations for real estate agents. Following is TREB’s market report for April 2014.

Following is TREB’s market report for April 2014.

I've mentioned in previous blog posts that the spring market shifts into its highest gear right after the Easter long weekend (read those posts

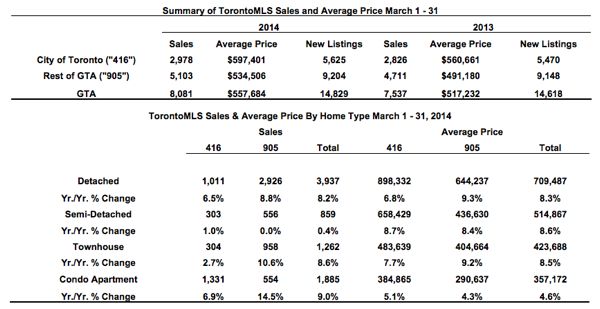

I've mentioned in previous blog posts that the spring market shifts into its highest gear right after the Easter long weekend (read those posts  Following is TREB’s market report for March 2014.

Following is TREB’s market report for March 2014.

When one thinks of iconic Toronto intersections, Yonge & Bloor undoubtedly comes to mind.

When one thinks of iconic Toronto intersections, Yonge & Bloor undoubtedly comes to mind.

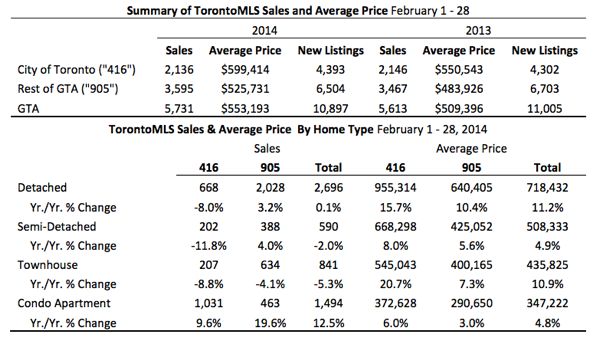

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

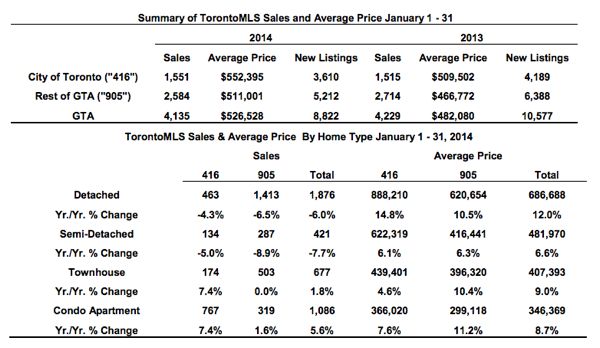

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Depending on the building's location, a condo locker typically sells for $3,500 - $5,000 on the resale market.

Depending on the building's location, a condo locker typically sells for $3,500 - $5,000 on the resale market.

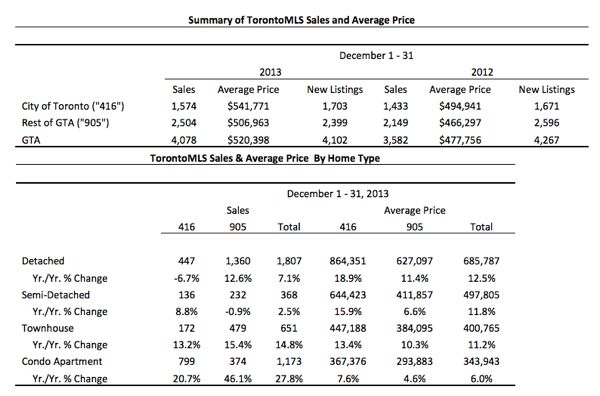

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

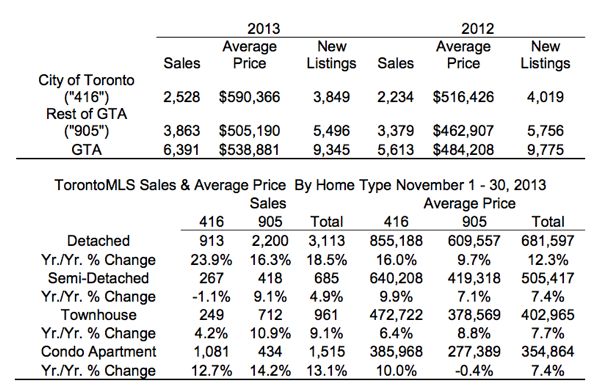

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

If you want to get the best price for your home, should you:

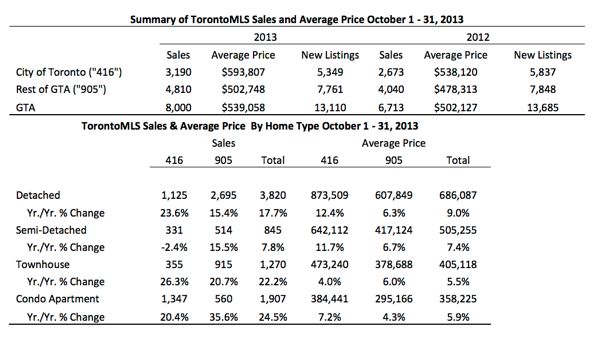

If you want to get the best price for your home, should you: Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

I was booking showings for a client the other day and one of the properties we wanted to see was restricting showings to Thursday evenings only, 6:00 - 9:00pm.

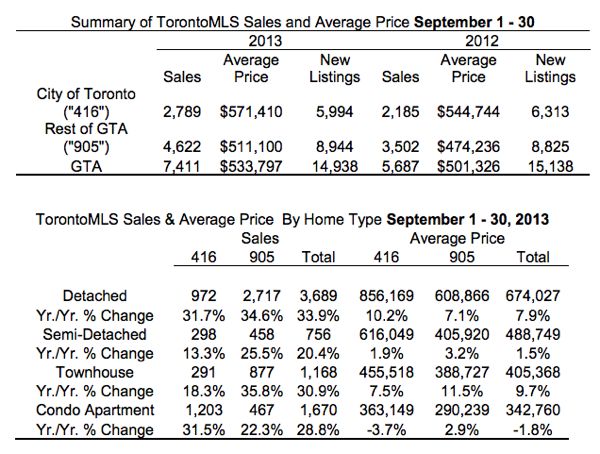

I was booking showings for a client the other day and one of the properties we wanted to see was restricting showings to Thursday evenings only, 6:00 - 9:00pm. Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.