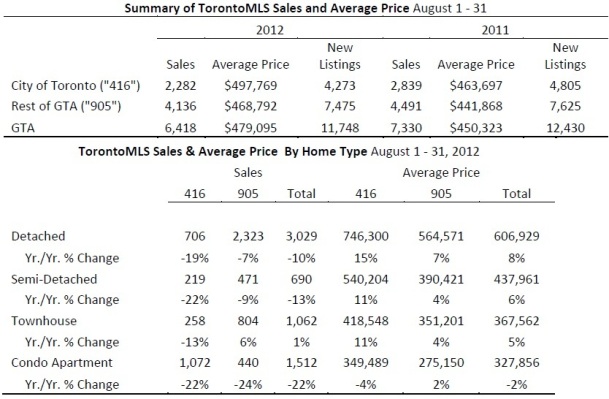

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

“Residential transactions were down in August compared to last year. Stricter mortgage lending guidelines, which came into effect in July, arguably played a role. In the City of Toronto, the additional impact of relatively higher home prices coupled with the upfront cost associated with the City’s Land Transfer Tax led to a stronger annual decline in sales compared to the rest of the GTA,” said Toronto Real Estate Board (TREB) President Ann Hannah.

The average selling price for August 2012 transactions was $479,095 – up by almost 6.5 per cent compared to August 2011. The annual rate of price growth was driven by the low-rise home segment in the City of Toronto, including single-detached homes with an average annual price increase of 15 per cent. The MLS® Home Price Index (MLS® HPI)* composite index, which allows for an apples-to-apples comparison of benchmark home prices from one year to the next, was up by 6.3 per cent year-over-year.

“While sales were down year-over-year in the GTA, so too were new listings. As a result, market conditions remained quite tight with substantial competition between buyers in the low-rise market segment,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

“The trends for sales and new listings are moving somewhat in synch, suggesting that the relationship between sales and listings will continue to promote price growth moving forward.”

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

The last few weeks in August are similar to the last few weeks in December in that these are the two times of year when a relatively large portion of the real estate market (buyers, sellers, and realtors) are away on vacation.

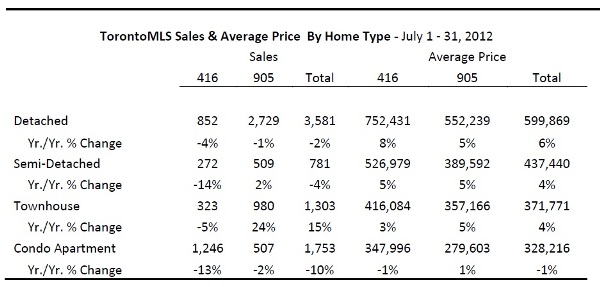

The last few weeks in August are similar to the last few weeks in December in that these are the two times of year when a relatively large portion of the real estate market (buyers, sellers, and realtors) are away on vacation. Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Anyone familiar with real estate in the Leslieville area knows that there isn’t much there in the way of residential condos/lofts. The majority of what’s available sits along the strip of Carlaw Ave that runs north of Queen Street East up to Dundas.

Anyone familiar with real estate in the Leslieville area knows that there isn’t much there in the way of residential condos/lofts. The majority of what’s available sits along the strip of Carlaw Ave that runs north of Queen Street East up to Dundas.

There’s been a lot of talk over the last few weeks about how many buyers out there are actually going to feel the sting of the new mortgage rules that came into effect on July 9th. While the media has been playing up the severity of the implications these new rules bring, most industry insiders feel that only a relative minority of purchasers will actually have their buying power significantly reduced.

There’s been a lot of talk over the last few weeks about how many buyers out there are actually going to feel the sting of the new mortgage rules that came into effect on July 9th. While the media has been playing up the severity of the implications these new rules bring, most industry insiders feel that only a relative minority of purchasers will actually have their buying power significantly reduced. Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

Toronto’s

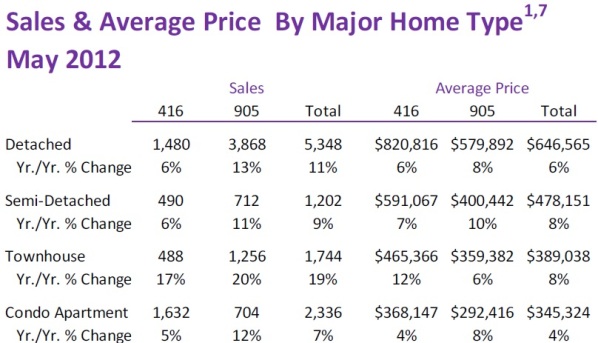

Toronto’s  Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

My wife and I have been known to watch a fair bit of television together. Although we share a love of many of the same shows (Twin Peaks, The Mighty Boosh, ...to name a few) our viewing habits are different. She’s happy to sit through marathon sessions of back-to-back-to-back episodes, whereas I like to spread mine out.

My wife and I have been known to watch a fair bit of television together. Although we share a love of many of the same shows (Twin Peaks, The Mighty Boosh, ...to name a few) our viewing habits are different. She’s happy to sit through marathon sessions of back-to-back-to-back episodes, whereas I like to spread mine out. Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

If you’re thinking of making a move and would like to know how I can help, feel free to

If you’re thinking of making a move and would like to know how I can help, feel free to  A couple of months ago I wrote a blog post asking the question, "Sellers: Should you have a pre-listing home inspection done?" (read it

A couple of months ago I wrote a blog post asking the question, "Sellers: Should you have a pre-listing home inspection done?" (read it  Two years ago I wrote a blog post asking the question, "When does the spring real estate market actually begin?"

Two years ago I wrote a blog post asking the question, "When does the spring real estate market actually begin?" Many feel that the spring market doesn't really begin until the month of March. There's some truth to this in the sense that March is generally when we start to see signs of warmer weather and buyers are more apt to tour the neighbourhood for open houses.

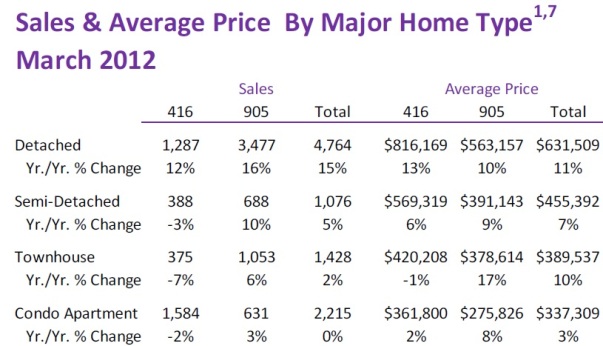

Many feel that the spring market doesn't really begin until the month of March. There's some truth to this in the sense that March is generally when we start to see signs of warmer weather and buyers are more apt to tour the neighbourhood for open houses. Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

I was viewing condos at Bathurst & Lakeshore earlier this week with a buyer client of mine. The plan was to see six properties in total, all located within two neighbouring buildings. We got in to see five of the properties, no problem. Unfortunately, condo number six - the one she really wanted to see - didn't go as smoothly...

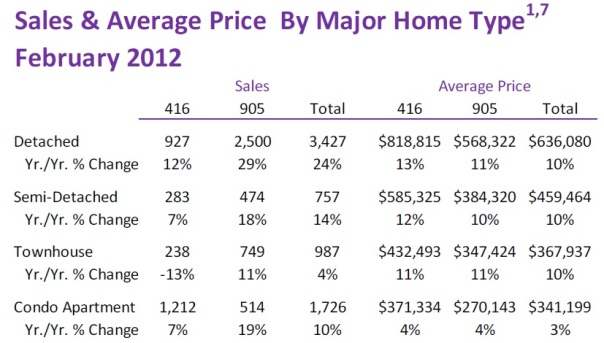

I was viewing condos at Bathurst & Lakeshore earlier this week with a buyer client of mine. The plan was to see six properties in total, all located within two neighbouring buildings. We got in to see five of the properties, no problem. Unfortunately, condo number six - the one she really wanted to see - didn't go as smoothly... Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

Gotta love the photo I chose for this blog post. Two scantily clad ladies, an enormous electric guitar, cardboard flames and a glass box full of millions. Ah, Vegas in all its mundane glory...

Gotta love the photo I chose for this blog post. Two scantily clad ladies, an enormous electric guitar, cardboard flames and a glass box full of millions. Ah, Vegas in all its mundane glory...

Over the last few years Queen Street West has seen its share of new residential development, the majority of which has sprung up around the Gladstone Hotel; Westside Lofts, The Bohemian Embassy, 2 Gladstone. Prior to these new buildings, Queen West was known more for the residential loft conversions that sit just west of Trinity Bellwoods Park; the

Over the last few years Queen Street West has seen its share of new residential development, the majority of which has sprung up around the Gladstone Hotel; Westside Lofts, The Bohemian Embassy, 2 Gladstone. Prior to these new buildings, Queen West was known more for the residential loft conversions that sit just west of Trinity Bellwoods Park; the