In the city of Toronto there are realtors who focus specifically on condos, and there are realtors who focus specifically on houses. There's a third group as well - the realtors who focus on both condos and houses. I'm one of those guys. Condos and houses each offer their own unique set of challenges, opportunities, and rewards. I can't imagine giving up one for the other.

In the city of Toronto there are realtors who focus specifically on condos, and there are realtors who focus specifically on houses. There's a third group as well - the realtors who focus on both condos and houses. I'm one of those guys. Condos and houses each offer their own unique set of challenges, opportunities, and rewards. I can't imagine giving up one for the other.

When it comes to buying/selling a condo versus buying/selling a house, there are a number of key differences to keep in mind. Part of my job is to educate my clients as to what these differences are and to make sure they understand how condo living differs from freehold ownership.

I've written articles in the past focusing on condo-specific ownership issues (for example, take a look at my article on status certificates here, or my article on condo townhouses here). The Toronto Real Estate Board has posted a few of their own articles on condo ownership as well. I've re-printed one of those articles in full, below. Take a look...

Following is the article, "Condo Ownership - What To Expect", as it appears on the Toronto Real Estate Board's website:

If you are considering the purchase of a condominium in the Greater Toronto Area you are one of many residents who recognize the numerous benefits of this type of property ownership. Offering affordability, proximity to desirable areas and limited maintenance, it’s no wonder that condominiums now represent one in every three resale home transactions in the GTA.

Before proceeding with your purchase though, it’s wise to gain an understanding of how condominium living differs from freehold ownership. As with any type of purchase, the golden rule when buying a condo is to get everything in writing. If you’re buying a new unit you can expect to receive a disclosure statement. It includes a description of the project’s most important features, bylaws that govern the corporation, rules that regulate owners’ living environment and the condominium corporation’s budget for the first year after registration. Incidentally, during the first year after registration, the condo corporations must undertake reserve fund studies, performance and turnover audits, and if the cost for such common expenses is underestimated, your developer must pay the difference.

If you are planning to buy a resale condominium, you should request a status certificate, which offers similar information and confirms that the owner is current with common expenses. It costs $100 and must be delivered within 10 days of request.

While the purchase of a resale condominium includes a firm closing date, the move-in date for a new condominium can be years in the future. In this case, the developer can extend closing dates but if your unit isn’t ready by their outside closing date, you can terminate the purchase agreement. Your developer will have the option of terminating the agreement as well, if they can’t meet certain conditions including sales of units, planning approval, and financing by specific dates. In this case your deposit is refunded with interest.

It’s more likely though, that you will be able to move in, beginning with an occupancy closing, which takes place until the condominium corporation is registered. In this case, until you take ownership you’re responsible for paying common expenses, realty taxes and interest on the purchase price’s unpaid balance, which is due on closing.

Once the developer loses majority control of the project, within 42 days all new owners may elect a Board of Directors, consisting of at least three Directors. Their responsibilities are significant. The Board must ensure monies are held in trust, funds are properly invested and records are kept. They can hire personnel to maintain common elements, enter into legal contracts with a percentage of owner consent, and buy and sell property for the use and benefit of owners. The Board also enforces the condominium’s documents (bylaw, and rules and declaration) which specify the units and common elements, each unit’s share of ownership, and the types of costs included in monthly expenses.

As an owner, you have many responsibilities as well. You are responsible for your mortgage, property taxes, common expenses, and fees to cover special expenses. Like the Board of Directors, you are bound by the condominium corporation’s declaration, bylaws and rules. The rules for example, will likely prohibit you from making structural changes without prior consent. You can’t damage or neglect your unit as doing so affects all property values. Similarly, you can’t do anything that may jeopardize the project’s insurance coverage. Common area changes are also off limits without prior consent.

Whether you are buying new or resale, it’s wise to enlist the services of a REALTOR® to ensure that you’re clear on all of your responsibilities with respect to condominium ownership. For more information visit www.TorontoRealEstateBoard.com

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks...

It's roundup time! Let's take a look back at some of the more interesting articles and photos that popped up over the past few weeks... On December 28th, the folks over at BuzzBuzzHome posted an informative infographic illustrating the CMHC's major predictions for the 2012 Canadian real estate market. The total number of units is expecting to increase by 1.9% over 2011. And the average price is expected to increase by 1.2% over 2011. Read the full article here.

On December 28th, the folks over at BuzzBuzzHome posted an informative infographic illustrating the CMHC's major predictions for the 2012 Canadian real estate market. The total number of units is expecting to increase by 1.9% over 2011. And the average price is expected to increase by 1.2% over 2011. Read the full article here.

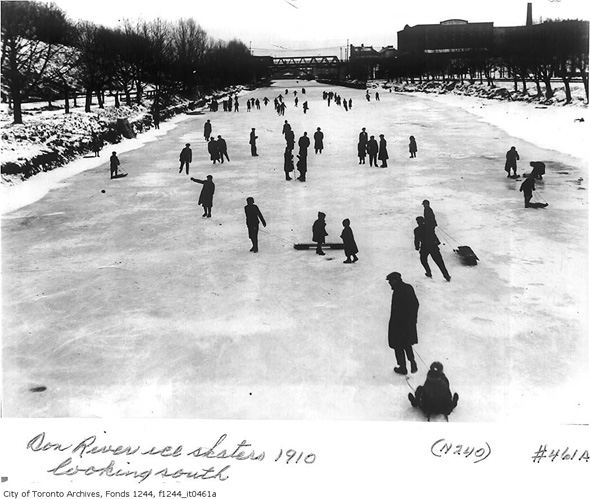

On January 4th, Dereck Flack of blogTO dipped into the city's digitized archival holdings to present us with a collection of snowy photos from Toronto's past. There are a bunch of wonderful images here, starting with a 12 horse team pulling a snow sweeper in the 1890's, to a snow storm seen from the corner of John & King in 1961. Read the full article here.

On January 4th, Dereck Flack of blogTO dipped into the city's digitized archival holdings to present us with a collection of snowy photos from Toronto's past. There are a bunch of wonderful images here, starting with a 12 horse team pulling a snow sweeper in the 1890's, to a snow storm seen from the corner of John & King in 1961. Read the full article here. On December 19th, Stephen Michalowicz of Torontoist.com nominated CityPlace condos in their year-end quest to name the very best and very worst people, places, things, and ideas that had an influence on the city in 2011. If you're not familiar with CityPlace, they're the buildings that sit at the foot of Spadina St, just south of Front St. The article points to poor build quality, poor insulation, water leaks, and poor planning issues as the reason for the nomination. Read the full article here.

On December 19th, Stephen Michalowicz of Torontoist.com nominated CityPlace condos in their year-end quest to name the very best and very worst people, places, things, and ideas that had an influence on the city in 2011. If you're not familiar with CityPlace, they're the buildings that sit at the foot of Spadina St, just south of Front St. The article points to poor build quality, poor insulation, water leaks, and poor planning issues as the reason for the nomination. Read the full article here. On December 15th, the Globe & Mail took a look back at the year's home sales and highlighted 10 properties that sold in the $490,000 - $550,000 range. There's everything from a 160 year old coach house in Port Hope, to a detached home in the beaches, to 2 bedroom condo near Church & Carlton. Read the full article here.

On December 15th, the Globe & Mail took a look back at the year's home sales and highlighted 10 properties that sold in the $490,000 - $550,000 range. There's everything from a 160 year old coach house in Port Hope, to a detached home in the beaches, to 2 bedroom condo near Church & Carlton. Read the full article here. On December 15th, Tristin Hopper of the National Post looked at the sale of one of the city's most beloved structures - the Flatiron building. The purchasers are a Toronto based company - the Commercial Realty Group. In case you're wondering, the $15.3M sale price works out to about $797.00/sq ft. Read the full article here.

On December 15th, Tristin Hopper of the National Post looked at the sale of one of the city's most beloved structures - the Flatiron building. The purchasers are a Toronto based company - the Commercial Realty Group. In case you're wondering, the $15.3M sale price works out to about $797.00/sq ft. Read the full article here.

I'd like to wish all of my loyal blog readers, clients, family and friends a safe and happy holiday season.

I'd like to wish all of my loyal blog readers, clients, family and friends a safe and happy holiday season.

There are a number of websites available that allow the public to search for properties currently listed for sale. Many of these websites belong to real estate agents (take

There are a number of websites available that allow the public to search for properties currently listed for sale. Many of these websites belong to real estate agents (take

I don't really do much "ranting" on this blog, but every now and then something comes up that compels me to throw in my 2 cents...

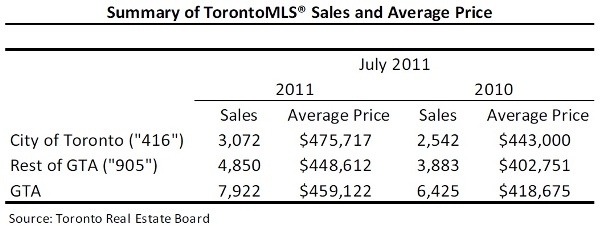

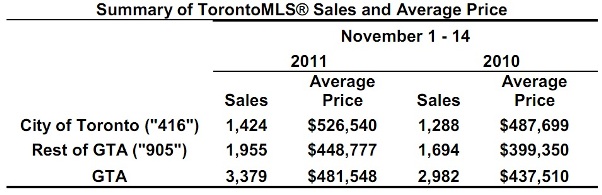

I don't really do much "ranting" on this blog, but every now and then something comes up that compels me to throw in my 2 cents... Following is TREB’s market report for mid-November 2011: Greater Toronto REALTORS® reported 3,379 transactions through the TorontoMLS® during the first two weeks of November. This result represented more than a 13 per cent increase compared to November 2010. New listings were up 16 per cent over the same period.

Following is TREB’s market report for mid-November 2011: Greater Toronto REALTORS® reported 3,379 transactions through the TorontoMLS® during the first two weeks of November. This result represented more than a 13 per cent increase compared to November 2010. New listings were up 16 per cent over the same period.

In the city of Toronto there are realtors who focus specifically on condos, and there are realtors who focus specifically on houses. There's a third group as well - the realtors who focus on both condos and houses. I'm one of those guys. Condos and houses each offer their own unique set of challenges, opportunities, and rewards. I can't imagine giving up one for the other.

In the city of Toronto there are realtors who focus specifically on condos, and there are realtors who focus specifically on houses. There's a third group as well - the realtors who focus on both condos and houses. I'm one of those guys. Condos and houses each offer their own unique set of challenges, opportunities, and rewards. I can't imagine giving up one for the other. Following is TREB’s market report for mid-October 2011: Greater Toronto REALTORS® reported 3,477 transactions through the TorontoMLS® system during the first 14 days of October 2011. This total represented a 20 per cent increase over 2,890 sales reported during the first two weeks of October 2010. Year-over-year growth in new listings for the same period was slightly stronger than that recorded for sales – up 21 per cent to 6,249.

Following is TREB’s market report for mid-October 2011: Greater Toronto REALTORS® reported 3,477 transactions through the TorontoMLS® system during the first 14 days of October 2011. This total represented a 20 per cent increase over 2,890 sales reported during the first two weeks of October 2010. Year-over-year growth in new listings for the same period was slightly stronger than that recorded for sales – up 21 per cent to 6,249.

Last August I wrote a BLOG post about the

Last August I wrote a BLOG post about the

Following is TREB’s market report for mid-September 2011: Greater Toronto REALTORS® reported 3,149 transactions during the first 14 days of September, representing an increase of more than 25 per cent in comparison to the first two weeks of September 2010. New listings over the same period, at 6,890, were up by 14 per cent compared to last year.

Following is TREB’s market report for mid-September 2011: Greater Toronto REALTORS® reported 3,149 transactions during the first 14 days of September, representing an increase of more than 25 per cent in comparison to the first two weeks of September 2010. New listings over the same period, at 6,890, were up by 14 per cent compared to last year.

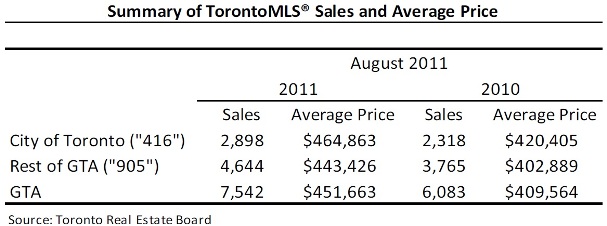

That's right, my real estate blog has been active for TWO YEARS now! I submitted my very first post in August of 2009 and haven't looked back since. I wrote a similar "Happy Birthday" post last August, celebrating my blog's first year of existence (you can read it

That's right, my real estate blog has been active for TWO YEARS now! I submitted my very first post in August of 2009 and haven't looked back since. I wrote a similar "Happy Birthday" post last August, celebrating my blog's first year of existence (you can read it  Following is TREB’s market report for mid-August 2011: There were 3,214 sales through the Toronto MLS® system during the first 14 days of August, representing more than a 22.5 per cent increase compared to the same period in August 2010. Year-to-date sales through the 14th of August were all but caught up to last year’s total – down by half a per cent compared to 2010.

Following is TREB’s market report for mid-August 2011: There were 3,214 sales through the Toronto MLS® system during the first 14 days of August, representing more than a 22.5 per cent increase compared to the same period in August 2010. Year-to-date sales through the 14th of August were all but caught up to last year’s total – down by half a per cent compared to 2010.