Every great neighbourhood has at least one major intersection that sits at what might be called the “heart” of the neighbourhood. These crossroads are known to locals and visitors alike, and they function as a sort of landmark or hub. Some neighbourhoods are lucky enough to have a few remarkable intersections. Case in point, the St Lawrence Market area in downtown Toronto.

Every great neighbourhood has at least one major intersection that sits at what might be called the “heart” of the neighbourhood. These crossroads are known to locals and visitors alike, and they function as a sort of landmark or hub. Some neighbourhoods are lucky enough to have a few remarkable intersections. Case in point, the St Lawrence Market area in downtown Toronto.

One of this neighbourhood’s key crossroads is where Front Street & Jarvis Street meet. Take a look at the Google Street View map here. You can see the Market itself, sitting on both the southwest and northwest corners. On the northeast corner you’ve got a handful of restaurants and pubs. And sitting on the southeast corner is one of the area’s more well known residential condo buildings, “New Times Square”.

New Times Square was developed by Camrost-Felcorp Inc. (also responsible for Kings Court , California Condos, and Imperial Plaza, among others) and designed by architects Page & Steele Inc. It was completed in 1999, has 12 floors, and the municipal address is 109 Front Street East.

I recently helped a client of mine purchase a 2 bedroom + den/2 bathroom suite in the building and she couldn't be happier with her new digs. Her balcony faces west and looks out over the Market, the CN Tower, and the gorgeous Toronto city skyline. There's no doubt the location was one of the major selling features for her, but that isn't to say the building itself doesn't have plenty to offer its residents.

The amenities include 24hr concierge, exercise room, whirlpool, sauna, and a rooftop terrace w/ bbq. The building is designed in such a way that some of the suites face out onto the city while others face onto an interior courtyard (there's a photo of the courtyard below). This is a nice touch as it gives purchasers the option of having something that's plugged into the energy of the area or something that's maybe a bit quiter. I’ve included a few more photos of the building and some of the common elements below.

If you own a suite in the New Times Square building and are thinking of selling, feel free to contact me for evaluation of your property or for more info on my listing services.

If you're thinking of purchasing a suite in the New Times Square building specifically, or in the St Lawrence Market Area in general, feel free to contact me for more info.

One of my favourite Real Estate blogs,

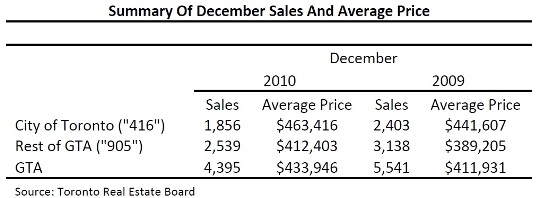

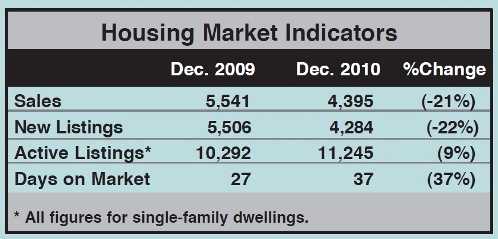

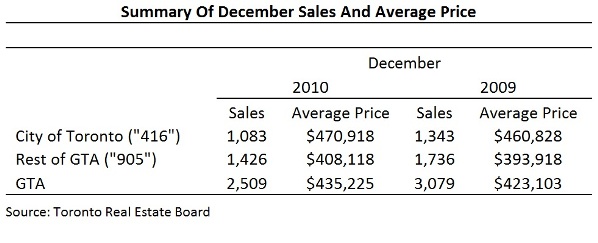

One of my favourite Real Estate blogs,  Following is TREB's market report for mid-Decemeber 2010: Greater Toronto REALTORS® reported 2,509 sales through the Multiple Listing Service® (MLS®) during the first two weeks of December 2010. This represented a 19 per cent decrease compared to the 3,079 sales recorded during the same period in December 2009. Year-to-date sales amounted to 84,316 – down one per cent from the 2009 total of 84,888.

Following is TREB's market report for mid-Decemeber 2010: Greater Toronto REALTORS® reported 2,509 sales through the Multiple Listing Service® (MLS®) during the first two weeks of December 2010. This represented a 19 per cent decrease compared to the 3,079 sales recorded during the same period in December 2009. Year-to-date sales amounted to 84,316 – down one per cent from the 2009 total of 84,888.

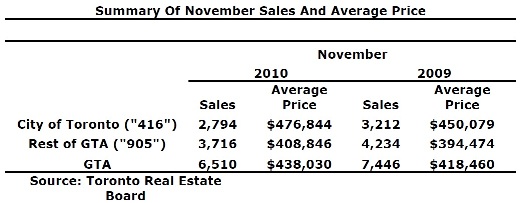

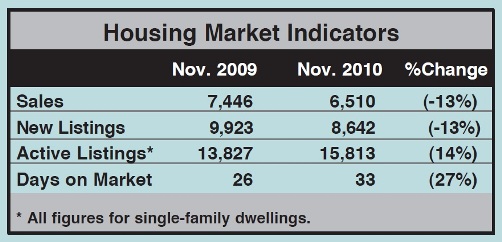

Following is TREB's market report for mid-November 2010: Greater Toronto REALTORS® reported 3,076 sales through the Multiple Listing Service® (MLS®) during the first two weeks of November 2010. This represented a 16 per cent decrease compared to the 3,666 sales recorded during the same period in November 2009. Year-to-date sales amounted to 78,526 – up slightly from the 2009 total.

Following is TREB's market report for mid-November 2010: Greater Toronto REALTORS® reported 3,076 sales through the Multiple Listing Service® (MLS®) during the first two weeks of November 2010. This represented a 16 per cent decrease compared to the 3,666 sales recorded during the same period in November 2009. Year-to-date sales amounted to 78,526 – up slightly from the 2009 total.

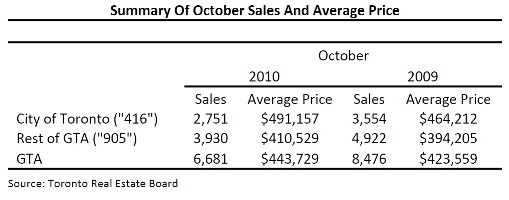

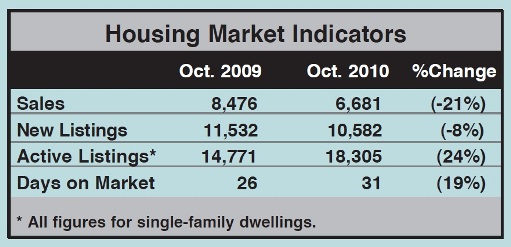

Following is TREB's market report for October 2010: Greater Toronto REALTORS® reported 6,681 sales through the Multiple Listing Service® (MLS®) in October 2010. This represented a 21 per cent decrease compared to the 8,476 sales recorded in October 2009. Through the first ten months of the year, sales amounted to 75,582 – up one per cent compared to the January through October period in 2009.

Following is TREB's market report for October 2010: Greater Toronto REALTORS® reported 6,681 sales through the Multiple Listing Service® (MLS®) in October 2010. This represented a 21 per cent decrease compared to the 8,476 sales recorded in October 2009. Through the first ten months of the year, sales amounted to 75,582 – up one per cent compared to the January through October period in 2009.

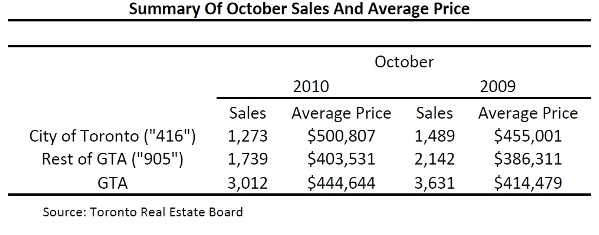

Following is TREB's market report for mid-October 2010: Greater Toronto REALTORS® reported 3,012 sales through the Multiple Listing Service® (MLS®) during the first two weeks of October 2010. This represented a 17 per cent decrease compared to the 3,631 sales recorded during the same period in 2009. Year-to-date sales amounted to 71,988, representing a three per cent increase compared to 2009.

Following is TREB's market report for mid-October 2010: Greater Toronto REALTORS® reported 3,012 sales through the Multiple Listing Service® (MLS®) during the first two weeks of October 2010. This represented a 17 per cent decrease compared to the 3,631 sales recorded during the same period in 2009. Year-to-date sales amounted to 71,988, representing a three per cent increase compared to 2009.

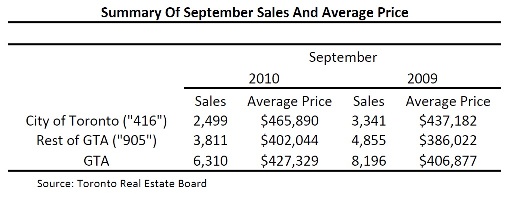

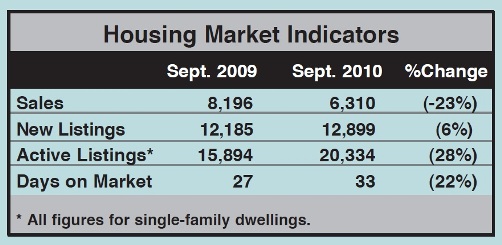

Following is TREB's market report for September 2010: Greater Toronto REALTORS® reported 6,310 sales through the Multiple Listing Service® (MLS®) in September 2010. This represented a 23 per cent decrease compared to the 8,196 sales recorded during the same period in 2009. Through the first nine months of the year, sales amounted to 69,069 – up four per cent compared to the first three quarters of 2009.

Following is TREB's market report for September 2010: Greater Toronto REALTORS® reported 6,310 sales through the Multiple Listing Service® (MLS®) in September 2010. This represented a 23 per cent decrease compared to the 8,196 sales recorded during the same period in 2009. Through the first nine months of the year, sales amounted to 69,069 – up four per cent compared to the first three quarters of 2009.

What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

What's the difference between a real estate Sales Representative and a Broker? What does it mean to be represented as a Client versus a Customer? What's an "ELF"? What's "CAC"? Every industry has its own set of terms and lingo, and Real Estate is certainly no different.

Following is TREB's market report for mid-September 2010: Greater Toronto REALTORS® reported 2,623 sales through the Multiple Listing Service® (MLS®) during the first two weeks of September 2010. This represented a 22 per cent decrease compared to the 3,361 sales recorded during the same period in 2009. Year-to-date sales amounted to 65,455, representing a six per cent increase compared to 2009.

Following is TREB's market report for mid-September 2010: Greater Toronto REALTORS® reported 2,623 sales through the Multiple Listing Service® (MLS®) during the first two weeks of September 2010. This represented a 22 per cent decrease compared to the 3,361 sales recorded during the same period in 2009. Year-to-date sales amounted to 65,455, representing a six per cent increase compared to 2009.

On Tuesday I helped a client of mine purchase a great 2 bedroom + den/2 bathroom condo in

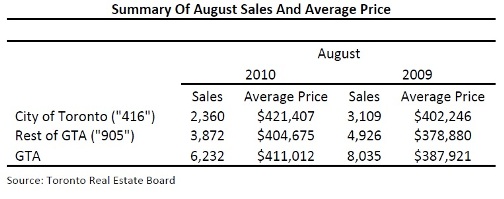

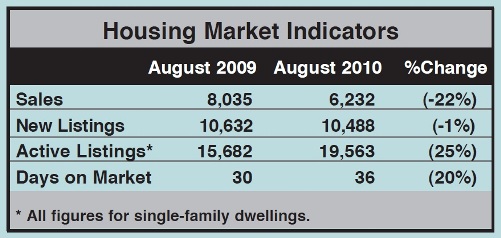

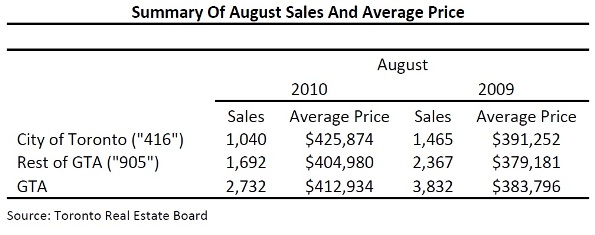

On Tuesday I helped a client of mine purchase a great 2 bedroom + den/2 bathroom condo in  Greater Toronto REALTORS® reported 6,232 sales through the Multiple Listing Service® (MLS®) in August 2010. This represented a 22 per cent decrease compared to the 8,035 sales recorded during the same period in 2009. New listings decreased by one per cent year-over-year to 10,488.

Greater Toronto REALTORS® reported 6,232 sales through the Multiple Listing Service® (MLS®) in August 2010. This represented a 22 per cent decrease compared to the 8,035 sales recorded during the same period in 2009. New listings decreased by one per cent year-over-year to 10,488.

Location, location, location. The 3 most important things in real estate, right? Certainly this adage applies to the condo building on Palmerston Ave known as "

Location, location, location. The 3 most important things in real estate, right? Certainly this adage applies to the condo building on Palmerston Ave known as "

Greater Toronto REALTORS® reported 2,732 sales through the Multiple Listing Service® (MLS®) during the first two weeks of August 2010. This represented a 29 per cent decrease compared to the 3,832 sales recorded during the same period in 2009. New listings, at 4,770 were down eight per cent compared to the first two weeks of August 2009.

Greater Toronto REALTORS® reported 2,732 sales through the Multiple Listing Service® (MLS®) during the first two weeks of August 2010. This represented a 29 per cent decrease compared to the 3,832 sales recorded during the same period in 2009. New listings, at 4,770 were down eight per cent compared to the first two weeks of August 2009.

Like anyone else, I've celebrated my share of milestones over the years. Kindergarten graduation, my first kiss, marriage, buying my first home... This week I'm proud add one more thing to the list - my real estate Blog is now one year old!

Like anyone else, I've celebrated my share of milestones over the years. Kindergarten graduation, my first kiss, marriage, buying my first home... This week I'm proud add one more thing to the list - my real estate Blog is now one year old!