Who likes a more balanced market? I do! I do! So far, this year's spring market has seen the arrival of more listings than we've had in awhile. Although we're still aways from being "balanced", Toronto's inventory shortage does seem to be easing up a bit.

Who likes a more balanced market? I do! I do! So far, this year's spring market has seen the arrival of more listings than we've had in awhile. Although we're still aways from being "balanced", Toronto's inventory shortage does seem to be easing up a bit.

Demand is certainly still very high. Although mortgage rates have started to increase, there are a number of buyers locked into record low rates for a few more months and the push is on for them to take advantage. The looming arrival of the HST is also motivating many to make a move by the end of June.

This rise in new listings and the resulting effect on the market is the subject of a press release today from the Canadian Real Estate Association (CREA). Although the release focuses on the country as a whole, it does touch in significant ways on the Toronto real estate market.

Following is today's press release from CREA in its entirety:

Homebuyers have more choice heading into the busy spring buying season, with new supply in Canada's resale housing market setting a record for the month of March. While resale housing demand remains strong, rising numbers of new listings are resulting in a more balanced national resale housing market.

According to statistics released by The Canadian Real Estate Association (CREA), some 97,663 residential properties were listed for sale on the Multiple Listing Service(R) (MLS(R)) Systems of Canadian real estate Boards in March 2010. This is an increase of 20 per cent from the previous March record set in 2008. A total of 233,402 new listings have come on stream since the beginning of the year, more than in any other first quarter period on record.

"Negotiations still favour sellers during the home buying process in a number of major Canadian housing markets," said CREA President Georges Pahud. "The rise in new listings means that buyers may shop around more before making an offer."

Demand remains very strong, but has edged lower compared to the record levels posted at the end of 2009. Seasonally adjusted national home sales totalled 130,072 units in the first three months of 2010. This represents the fourth highest quarterly level on record, down 3.4 per cent from the quarterly peak in the fourth quarter of last year. Sales activity in Ontario, Quebec, and Newfoundland & Labrador rose to new records in the first quarter. Higher activity in these provinces was offset by a decline in activity in British Columbia (-17.8 per cent) and Alberta (-9.7 per cent).

Actual (not seasonally adjusted) sales numbered 111,110 units in the first quarter of 2010. This is the third highest level ever for the first quarter period.

A total of 43,621 homes traded hands through Boards' MLS(R) Systems on a seasonally adjusted basis in March 2010. This is an increase of 1.4 per cent from February, as further gains in Toronto more than offset a decline in activity in Vancouver. Seasonally adjusted sales scaled new heights in Toronto and Ottawa in March.

Unadjusted national sales activity numbered 49,256 units in March. This marks the second highest level on record for the month of March. On a year-over-year basis, sales were up 40.8 per cent, smaller than those of the previous five months. Since a year will soon have elapsed following the recessionary decline and subsequent rebound for the Canadian resale market, year-over-year comparisons are expected to continue shrinking in the months ahead.

The national average price of homes sold via Canadian MLS(R) Systems in March was $340,920. This is the second highest national average price on record, just $300 below the peak reached last October. Compared to March 2009, the national average home price was up 17.6 per cent. As with sales activity, the increase was smaller than those recorded over the past five months, and year-over-year gains are expected to become further subdued as the year progresses.

The price trend is similar but less dramatic for the national weighted average price, which compensates for changes in provincial sales activity by taking into account provincial proportions of privately owned housing stock. It climbed 16 per cent on a year-over-year basis in March 2010.

The residential average price in Canada's major markets climbed 19 per cent year-over-year to $373,835 in March. As with the national counterpart, the price trend is similar but less dramatic for the major market weighted average price, which rose 17 per cent from levels reported in March 2009.

There were 214,312 homes listed for sale on Boards' MLS(R) Systems in Canada at the end of March 2010, a decline of nine per cent compared to the elevated levels of one year ago. This is the smallest year-over-year decline in active listings since June 2009.

The actual (not seasonally adjusted) number of months of inventory in March 2010 stood at 4.4 months. While well below where it stood one year ago (6.7 months), and down slightly from March 2008 (five months), months of inventory are higher compared to March from 2004 through 2007. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

On a seasonally adjusted basis, months of inventory stood at 4.6 months in March. This was little changed from February, but stands above levels reported in the previous four months.

"The erosion of housing affordability is crimping activity in some of Canada's priciest markets in the lower mainland of British Columbia," said CREA Chief Economist Gregory Klump. "Higher mortgage interest rates and the rise in new listings may also soon reduce some of the urgency to purchase in Toronto. Sales activity in British Columbia and Ontario is expected to ease over the second half of 2010 once the HST comes into effect, pulling national activity lower. Rising supply and lower activity will take the steam out of the pricing environment following upbeat home sales this spring."

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

Greater Toronto REALTORS® reported 6,564 sales in July – a 34 per cent dip from the record 9,967 sales reported in July 2009. New listings, at 10,825, dropped to the lowest level for the month of July since 2002. “The level of July sales remained below the expected long-term trend. The market has become more balanced following record monthly sales through most of the winter and early spring,” said Toronto Real Estate Board (TREB) President Bill Johnston.

Greater Toronto REALTORS® reported 6,564 sales in July – a 34 per cent dip from the record 9,967 sales reported in July 2009. New listings, at 10,825, dropped to the lowest level for the month of July since 2002. “The level of July sales remained below the expected long-term trend. The market has become more balanced following record monthly sales through most of the winter and early spring,” said Toronto Real Estate Board (TREB) President Bill Johnston.

In the Toronto real estate market, tenanted properties come up for sale all the time. Listings for houses with basement tenants, for example, are quite common. And there’s certainly no shortage of renter-occupied condos for sale. There’s one very important distinguishing question for the potential buyer of such a property though, “Can I take vacant possession or do I have to assume the tenant?”

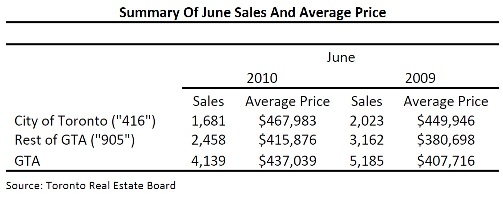

In the Toronto real estate market, tenanted properties come up for sale all the time. Listings for houses with basement tenants, for example, are quite common. And there’s certainly no shortage of renter-occupied condos for sale. There’s one very important distinguishing question for the potential buyer of such a property though, “Can I take vacant possession or do I have to assume the tenant?” Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985...

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985...

More often than not, when I meet someone looking to purchase a condo in the

More often than not, when I meet someone looking to purchase a condo in the

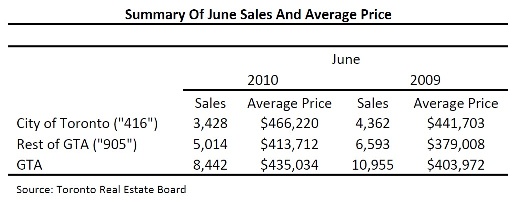

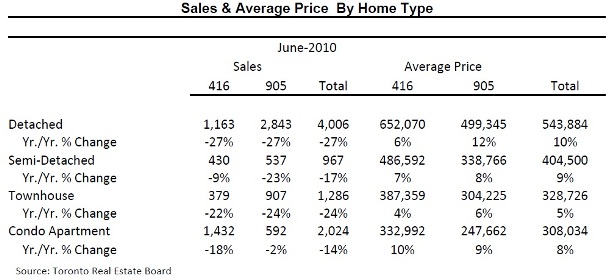

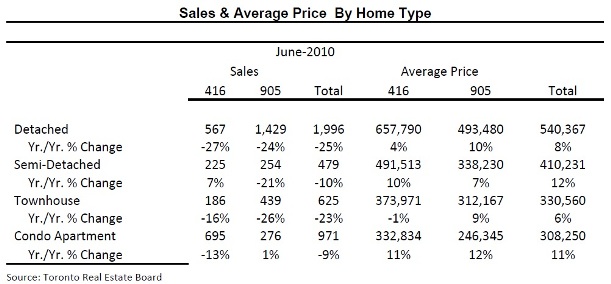

Greater Toronto REALTORS® reported 8,442 sales through the Multiple Listing Service® (MLS®) in June. This represented a 23 per cent decrease compared to the record 10,955 sales reported in June 2009. Sales for the second quarter of 2010 amounted to 28,810 – up one percent annually. Year-to-date sales through June were up 23 per cent to 50,455compared to the first six months of 2009.

Greater Toronto REALTORS® reported 8,442 sales through the Multiple Listing Service® (MLS®) in June. This represented a 23 per cent decrease compared to the record 10,955 sales reported in June 2009. Sales for the second quarter of 2010 amounted to 28,810 – up one percent annually. Year-to-date sales through June were up 23 per cent to 50,455compared to the first six months of 2009.

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985.

Greater Toronto REALTORS® reported 4,139 sales through the Multiple Listing Service® (MLS®) during the first two weeks of June 2010. This represented a 20 per cent decrease compared to the 5,185 sales recorded during the same period in 2009. New listings increased by 21 per cent annually to 7,985.

Earlier this year I wrote a Blog post about the coming of

Earlier this year I wrote a Blog post about the coming of  I was recently speaking with a couple of friends who are thinking of selling their condo and moving into something bigger. "We're hearing that prices are cooling off - should we wait awhile before making a move?" Good question. Unfortunately, there isn't one catch-all answer.

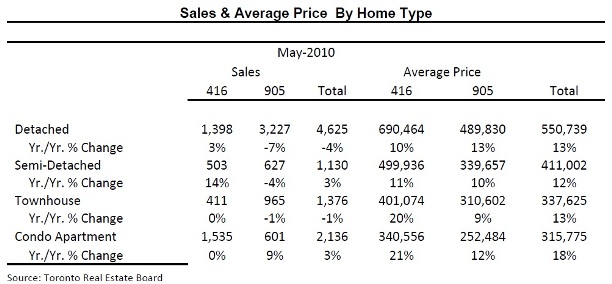

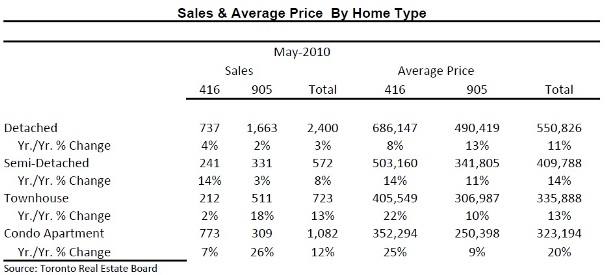

I was recently speaking with a couple of friends who are thinking of selling their condo and moving into something bigger. "We're hearing that prices are cooling off - should we wait awhile before making a move?" Good question. Unfortunately, there isn't one catch-all answer.  Greater Toronto REALTORS® reported 9,470 sales through the Multiple Listing Service® (MLS®) in May, representing a one per cent dip from May 2009. In comparison to previous years, this was the third highest May sales result on record.

Greater Toronto REALTORS® reported 9,470 sales through the Multiple Listing Service® (MLS®) in May, representing a one per cent dip from May 2009. In comparison to previous years, this was the third highest May sales result on record.

If you were to stop someone on the street in Toronto and ask them, "Can you name a residential loft building here in the city?" I bet the answer you'd hear most would be, "

If you were to stop someone on the street in Toronto and ask them, "Can you name a residential loft building here in the city?" I bet the answer you'd hear most would be, "

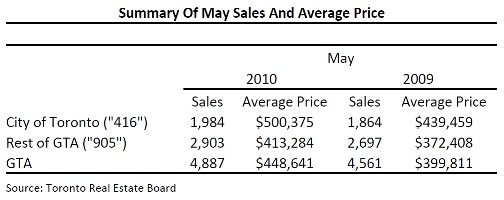

Greater Toronto REALTORS® reported 4,887 sales through the Multiple Listing Service® (MLS®) during the first two weeks of May. This represented a seven per cent increase compared to the 4,561 sales recorded during the same period in 2009. New listings increased by 48 per cent annually to 10,059.

Greater Toronto REALTORS® reported 4,887 sales through the Multiple Listing Service® (MLS®) during the first two weeks of May. This represented a seven per cent increase compared to the 4,561 sales recorded during the same period in 2009. New listings increased by 48 per cent annually to 10,059.

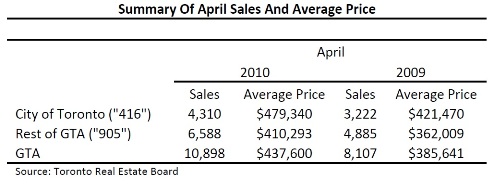

Greater Toronto REALTORS® reported 10,898 sales through the Multiple Listing Service® (MLS®) in April, representing a 34 per cent increase compared to April 2009. There were also 20,683 new listings in April – a 59 per cent annual increase. Both the sales and new listings results amounted to new records for the month of April under the current Toronto Real Estate Board (TREB) boundaries.

Greater Toronto REALTORS® reported 10,898 sales through the Multiple Listing Service® (MLS®) in April, representing a 34 per cent increase compared to April 2009. There were also 20,683 new listings in April – a 59 per cent annual increase. Both the sales and new listings results amounted to new records for the month of April under the current Toronto Real Estate Board (TREB) boundaries.

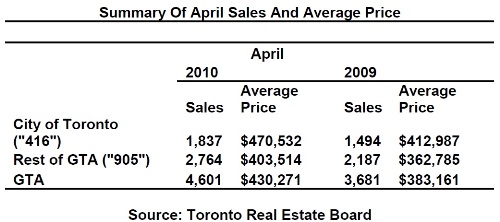

Greater Toronto REALTORS® reported 4,601 sales through the Multiple Listing Service® (MLS®) during the first two weeks of April. This represented a 25 per cent increase compared to the 3,681 sales recorded during the same period in 2009. New listings increased by 48 per cent annually to 9,512.

Greater Toronto REALTORS® reported 4,601 sales through the Multiple Listing Service® (MLS®) during the first two weeks of April. This represented a 25 per cent increase compared to the 3,681 sales recorded during the same period in 2009. New listings increased by 48 per cent annually to 9,512.

Who likes a more balanced market? I do! I do! So far, this year's spring market has seen the arrival of more listings than we've had in awhile. Although we're still aways from being "balanced", Toronto's inventory shortage does seem to be easing up a bit.

Who likes a more balanced market? I do! I do! So far, this year's spring market has seen the arrival of more listings than we've had in awhile. Although we're still aways from being "balanced", Toronto's inventory shortage does seem to be easing up a bit. Greater Toronto REALTORS® reported 10,430 sales through the Multiple Listing Service® (MLS®) in March, pushing total first quarter 2010 sales to 22,418 – the best result on record under the current Toronto Real Estate Board (TREB) boundaries. The average price for March transactions was $434,696. The average price for the first quarter was $427,948.

Greater Toronto REALTORS® reported 10,430 sales through the Multiple Listing Service® (MLS®) in March, pushing total first quarter 2010 sales to 22,418 – the best result on record under the current Toronto Real Estate Board (TREB) boundaries. The average price for March transactions was $434,696. The average price for the first quarter was $427,948.

The

The

The recent issues between the Canadian Real Estate Association and the Canadian Competition Bureau have sparked a handful of fruitful conversations between myself and friends, clients, etc, over the past few weeks. I've found myself more than once listing off the many ways a person benefits by using a realtor to buy or sell their home. Sitting near the top of this list is the detailed knowledge a realtor has of the market in both broad and specific terms.

The recent issues between the Canadian Real Estate Association and the Canadian Competition Bureau have sparked a handful of fruitful conversations between myself and friends, clients, etc, over the past few weeks. I've found myself more than once listing off the many ways a person benefits by using a realtor to buy or sell their home. Sitting near the top of this list is the detailed knowledge a realtor has of the market in both broad and specific terms.