Following is TREB’s market report for January 2015:

Toronto Real Estate Board President Paul Etherington announced a strong start to 2015, with robust year-over-year sales and average price growth in January.

Greater Toronto Area REALTORS® reported 4,355 home sales through the TorontoMLS system during the first month of the year.

This result represented a 6.1 per cent increase over January 2014.

During the same period, new listings were up by 9.5 per cent.

"The January results represented good news on multiple fronts.

First, strong sales growth suggests home buyers continue to see housing as a quality long-term investment, despite the recent period of economic uncertainty.

Second, the fact that new listings grew at a faster pace than sales suggests that it has become easier for some people to find a home that meets their needs," said Mr. Etherington.

The average selling price for January 2015 home sales was up by 4.9 per cent year-over- year to $552,575.

The MLS® Home Price Index (HPI) Composite benchmark was up by 7.5 percent compared to January 2014.

"Home price growth is forecast to continue in 2015.

Lower borrowing costs will largely mitigate price growth this year, which means affordability will remain in check.

The strongest rates of price growth will be experienced for low-rise home types, including singles, semis and town houses.

However, robust end-user demand for condo apartments will result in above-inflation price growth in the high-rise segment as well," said Jason Mercer, TREB's Director of Market Analysis.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

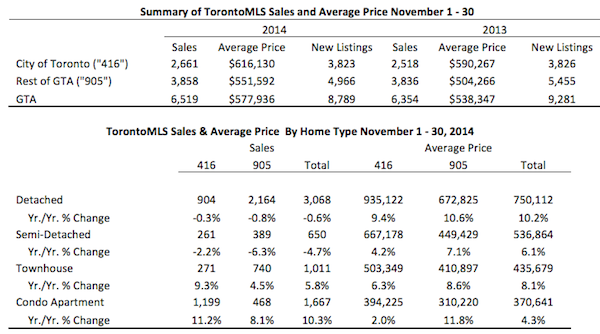

Following is TREB’s market report for November 2014:

Following is TREB’s market report for November 2014:

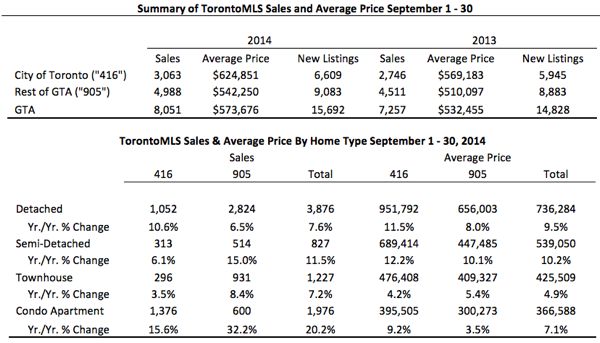

Following is TREB’s market report for September 2014:

Following is TREB’s market report for September 2014:

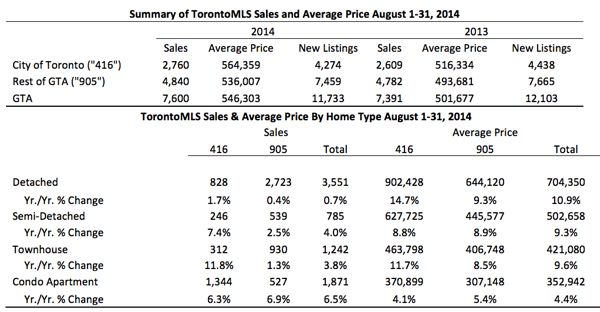

Following is TREB’s market report for August 2014:

Following is TREB’s market report for August 2014:

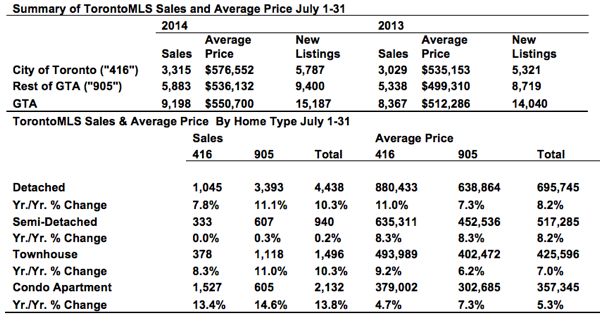

Following is TREB’s market report for July 2014.

Following is TREB’s market report for July 2014.

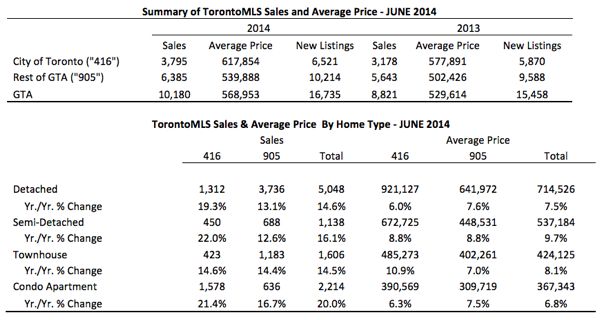

Following is TREB’s market report for June 2014.

Following is TREB’s market report for June 2014.

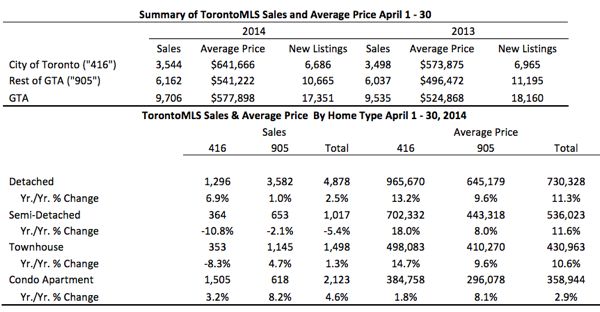

Following is TREB’s market report for April 2014.

Following is TREB’s market report for April 2014.

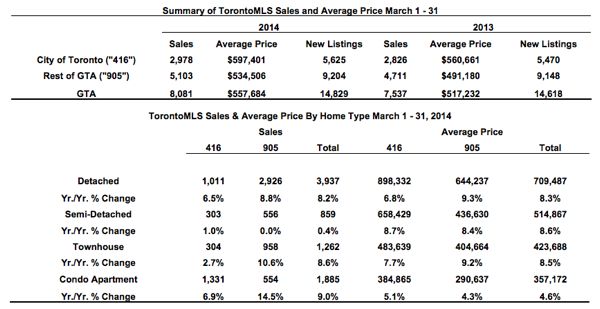

Following is TREB’s market report for March 2014.

Following is TREB’s market report for March 2014.

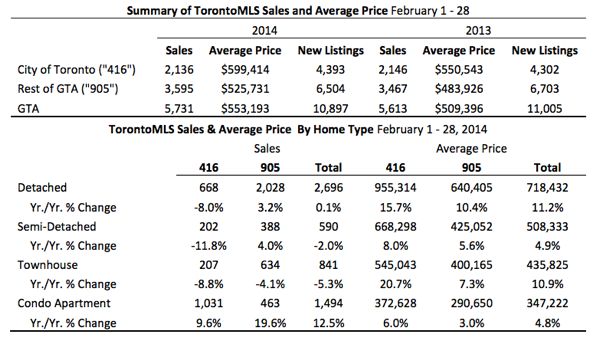

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

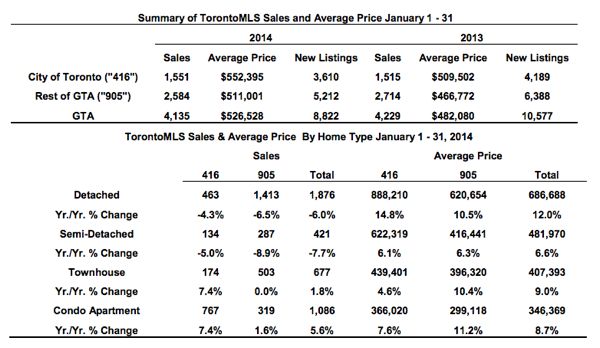

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

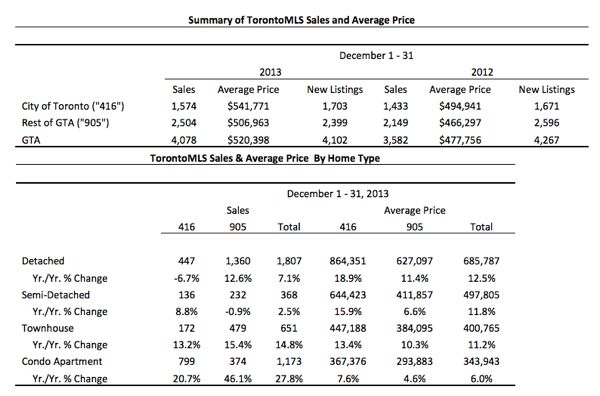

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

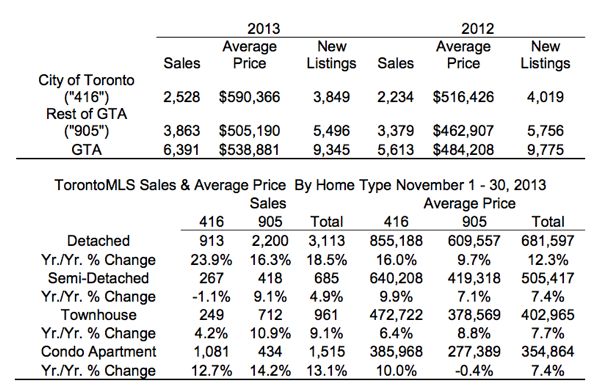

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

If you want to get the best price for your home, should you:

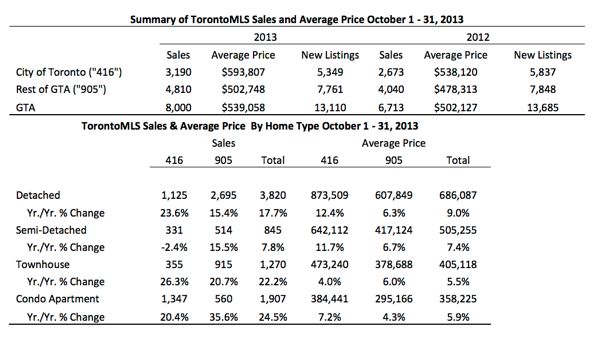

If you want to get the best price for your home, should you: Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

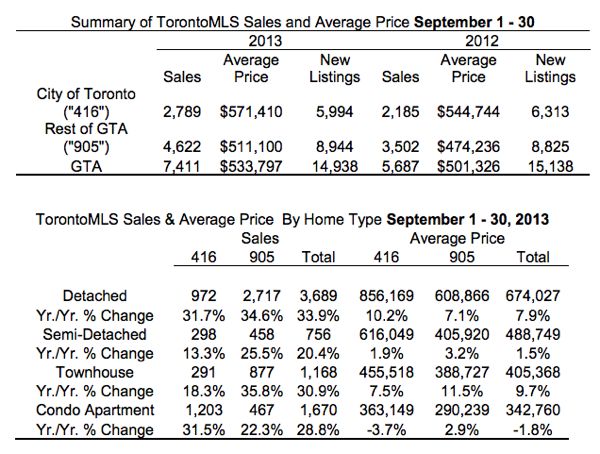

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

t

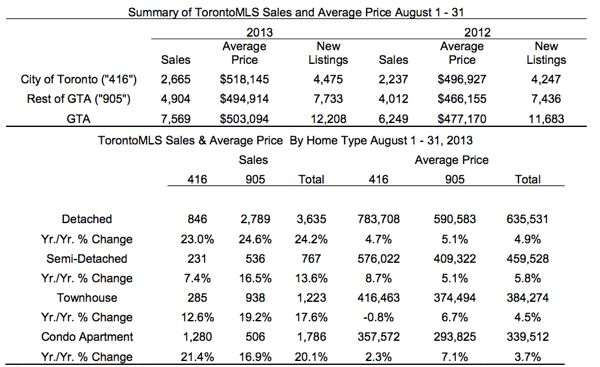

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

t

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

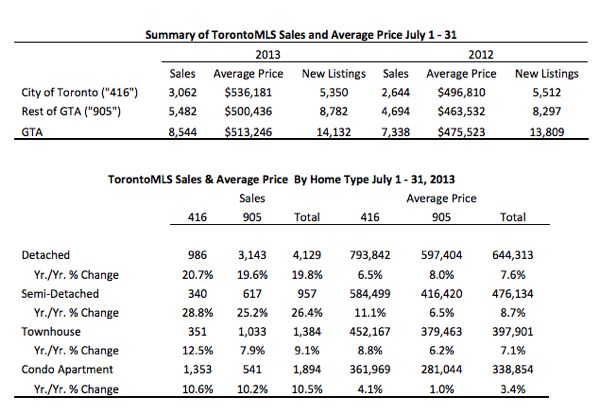

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

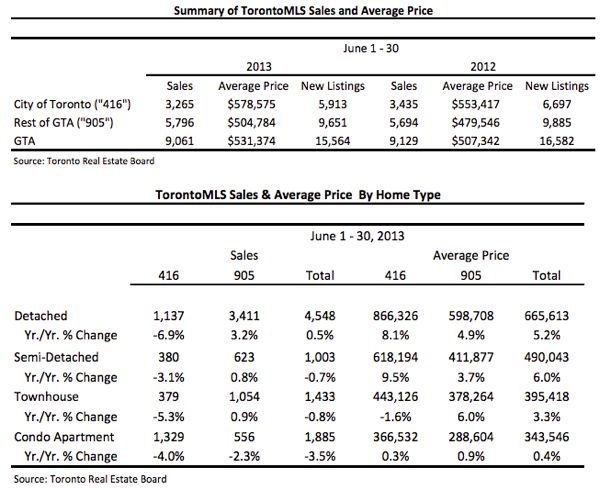

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

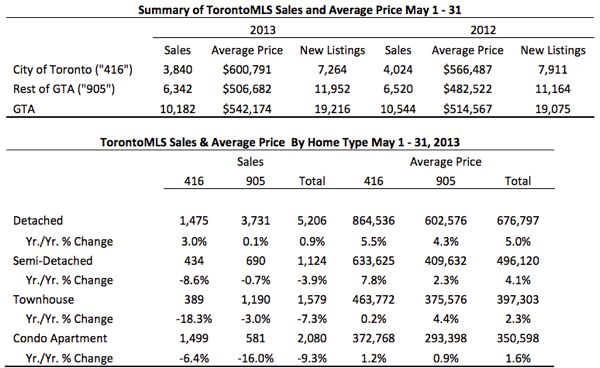

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.